Informing Strategic Planning Amid Tariff Uncertainty for Canadian Municipalities

Oxford Economics Australia delivered customised forecasts for FY2026 and FY2027, helping municipalities quantify the impact of tariffs on construction costs and enabling AMO to support smarter procurement, budgeting, and stakeholder engagement.

Background: Uncertainty in Global Trade Policy Poses Hidden Budget Risks for Ontario Municipalities

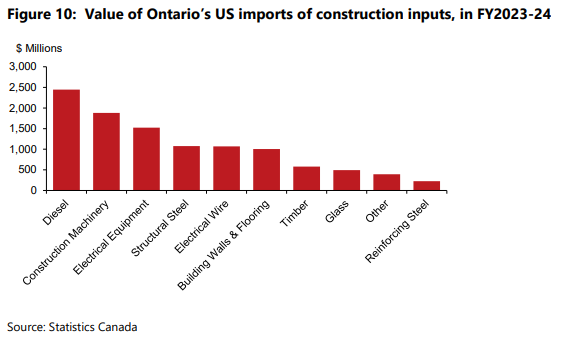

The Association of Municipalities of Ontario (AMO) needed to understand how recent US-imposed trade tariffs and the threat of further escalation could affect local infrastructure investment. Given municipalities’ reliance on a wide range of imported construction materials, and with procurement decisions often locked in years in advance, tariff volatility created a significant budgeting risk and a blind spot in capital planning processes.

The Challenge: Estimating Tariff Impacts Across Diverse Construction Inputs and Municipal Profiles

Ontario municipalities vary considerably in size, infrastructure priorities, and fiscal capacity. The challenge was to quantify the economic consequences of multiple tariff scenarios on a broad array of construction inputs such as machinery, vehicles, fuel, and manufactured goods while ensuring that the insights would be relevant and actionable across both rural and urban contexts. The forecast also needed to account for inflation, supply chain disruptions, and evolving policy risks, specifically for fiscal years 2025–26 and 2026–27.

The Solution: Data-Driven Scenario Forecasting Supports Smarter Capital Planning and Advocacy

Oxford Economics Australia developed a set of forward-looking economic scenarios to simulate how trade tariffs would impact material input costs and municipal capital expenditure across Ontario. The study modelled Canadian retaliatory tariffs of 10–25% on a range of goods and estimated the resulting cost implications for planned infrastructure spending.

Deliverables included:

- Forecast models estimating tariff-induced capital cost increases by asset type and material category.

- Price escalation analysis across high-impact goods such as construction machinery, vehicles, and electrical components.

- Municipality-level insights to support capital budgeting, procurement planning, and advocacy.

Impact for AMO and Municipalities:

The findings enabled AMO and its members to adjust procurement strategies, engage more confidently with stakeholders, and advocate for federal support ultimately reducing the risk of over- or under-budgeting critical infrastructure investments.