Trump talks business on GCC tour, with a sprinkle of diplomacy

The Gulf Cooperation Council (GCC) region concluded an eventful week as Saudi Arabia, Qatar, and the UAE hosted President Trump on his first major foreign trip since re-assuming office, underscoring an enduring strategic partnership.

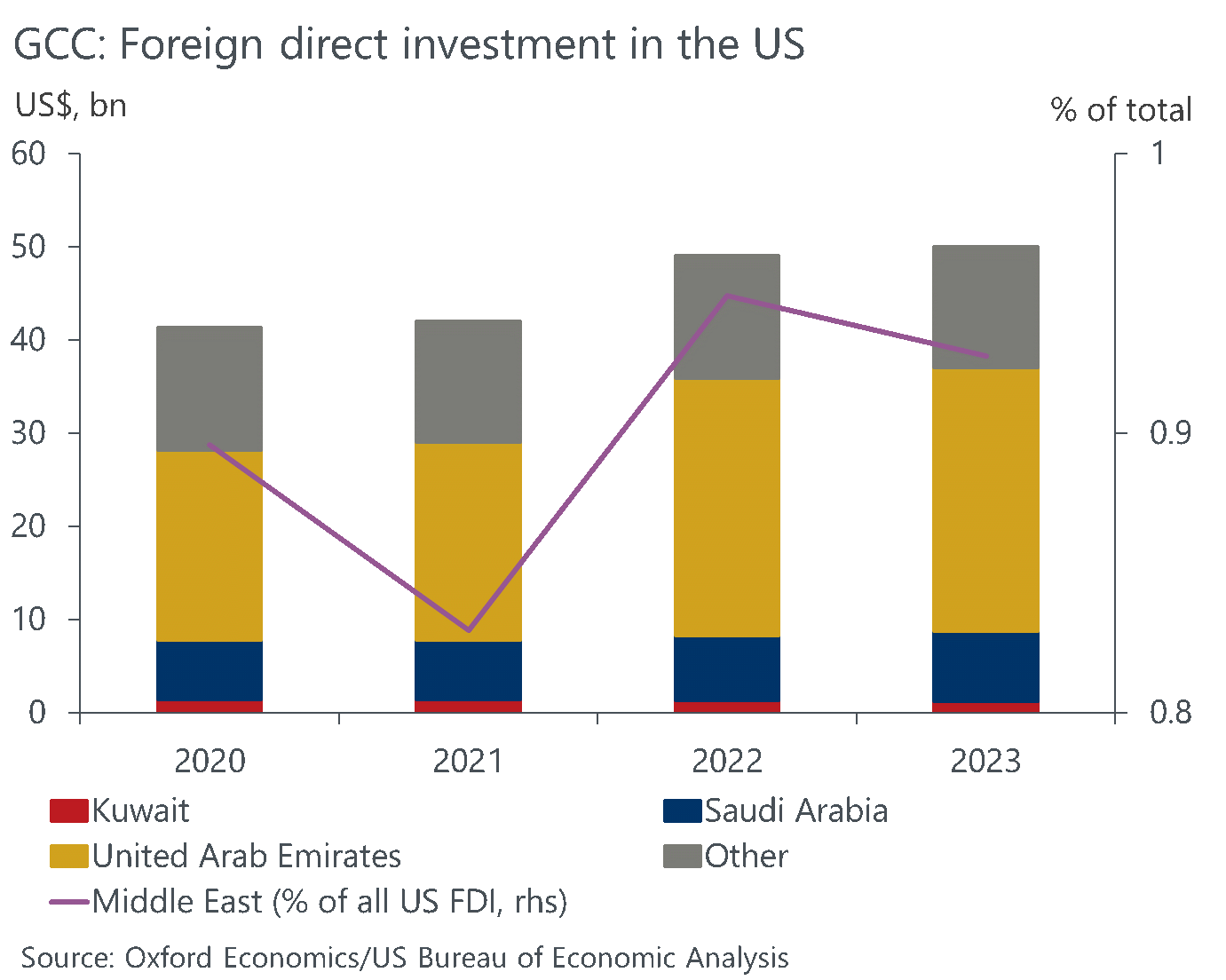

In the context of heightened global trade tensions, trade and investment deals took centre stage. As indicated in White House fact sheets, Trump mobilised just over $1trn of investments for the US, spanning several industries including civil engineering and defence. Although there is a lot of uncertainty over specifics, the announcements mark significant investment, consistent with the region’s growth and diversification plans.

During his visit to Saudi Arabia, Trump secured a $600bn investment pledge (initially hinted in January), short of the $1trn he aimed for, but he came away with the largest arms deal in history valued at $142bn along with numerous energy and mineral agreements. Absent a rebound in global energy prices, Saudi commitment to delivering on domestic investment could restrict its ability to fulfil overseas investment pledge within the four-year timeframe.

In Qatar, Boeing secured its largest ever order, which will enhance capacity in transport and storage, Qatar’s third-largest priority sector, which we think has a good chance of meeting and even overshooting the Vision 2030 target. Meanwhile, Qatar’s sovereign wealth fund (QIA) signalled an additional $500bn in US investment over the next decade, narrowing the gap between the $243.5bn in announced deals and the $1.2trn economic commitment noted by the White House.

The UAE confirmed it would invest $1.4trn in the US over the next 10 years, focused on AI, while inking $200bn in deals, including the launch of the largest AI facility outside the US.

Economic insights focusing on the Middle East that help you understand the local market conditions.

Find out moreBoth Saudi Arabia and the UAE are well placed to leverage the announced technology and AI agreements in line with the region’s diversification objectives. Enhanced access to Nvidia chips along with new infrastructure will accelerate AI adoption and foster innovation. A recent study classified both countries as ‘AI rising contenders’.

The agreements could catalyse stronger FDI inflows. Indeed, the Saudi government targets 5.7% of GDP in FDI by 2030, requiring a significant increase after FDI declined for a third consecutive year in 2024, to $20.7bn (1.9% of GDP).

Diplomacy may not have been the focal point but there were some important announcements. The key foreign policy development impacting the broader Middle East was Trump’s unexpected decision to lift US sanctions on Syria. This removes the key barrier to the country’s recovery, which will prompt an upward adjustment to our baseline outlook.

Iran appears to be inching closer to a nuclear agreement and sanctions relief. Although the terms of a future deal remain uncertain, the ‘serious negotiations’ mentioned by Trump (and facilitated by Oman) introduce a potential upside risk for Iran’s economic prospects.

The ongoing conflict in Gaza presents more challenge and Trump acknowledges that a breakthrough is essential for Saudi Arabia’s eventual participation in the Abraham Accords.

Speak to us

If you would like to find out more about our services, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

Related Content

Tags: