Tradable inflation expected to stay muted in 2025 in Australia

Easing global pressures drove inflation lower, but rising import prices signal emerging risks.

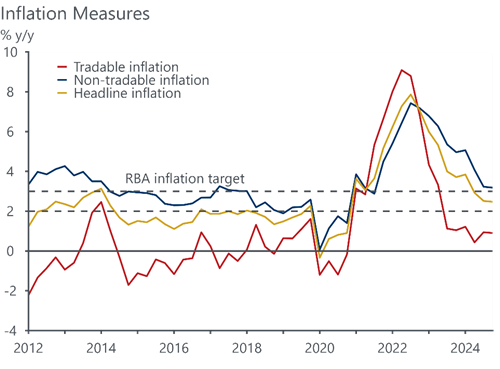

Headline inflation eased to 2.4% y/y in Q1 2025, down sharply from a peak of 7.8% peak in late 2022. The decline has been driven mainly by a slowdown in tradable inflation, which fell to 0.9% y/y, compared to 3.2% for non-tradables. The fall in tradables inflation reflects global factors such as lower oil prices and easing import costs as supply chains normalised.

The initial rise in tradables inflation was in part driven by surging fuel prices. Global oil prices more than doubled after Russia’s invasion of Ukraine in 2022. Other key contributors included imported food, beverages, and international travel, which surged due to global supply disruptions and a sharp post-COVID rebound in demand.

More recently, import prices – a key leading indicator – have picked up amid renewed global uncertainty following President Donald Trump’s tariff announcements. A weaker Australian dollar and increased demand for non-monetary gold have also pushed import prices higher.

Chart 1: Headline inflation steadily declines from 2022 peak, with tradable component easing lower