IFRS 9 and the BCST: How the Bank of England’s Latest Stress Test Measures Economic Shocks

Earlier this year, the Bank of England (BoE) published its updated stress test for the UK banking system, replacing the Annual Cyclical Scenario (ACS) with the new Banking Capital Stress Test (BCST).

This was the first stress test released by the Bank following the conclusion of the IFRS 9 ‘transitional arrangements’ which allowed banks to gradually adjust to the new regulatory requirements. Under the IFRS 9 accounting standard banks are required to record losses much earlier than under the previous accounting standard (IAS 39), thereby enhancing the capital buffers of lenders and thus the stability of the wider financial system.

The incorporation of IFRS 9 into banking system stress tests has led to changes in their methodology as well, as they now need to take into account the earlier provisioning under the new accounting standard. As a result, the Bank of England has recalibrated its scenario guidance, delaying the timing of peaks and troughs of key drivers of credit losses, as well as simplifying its methodology.

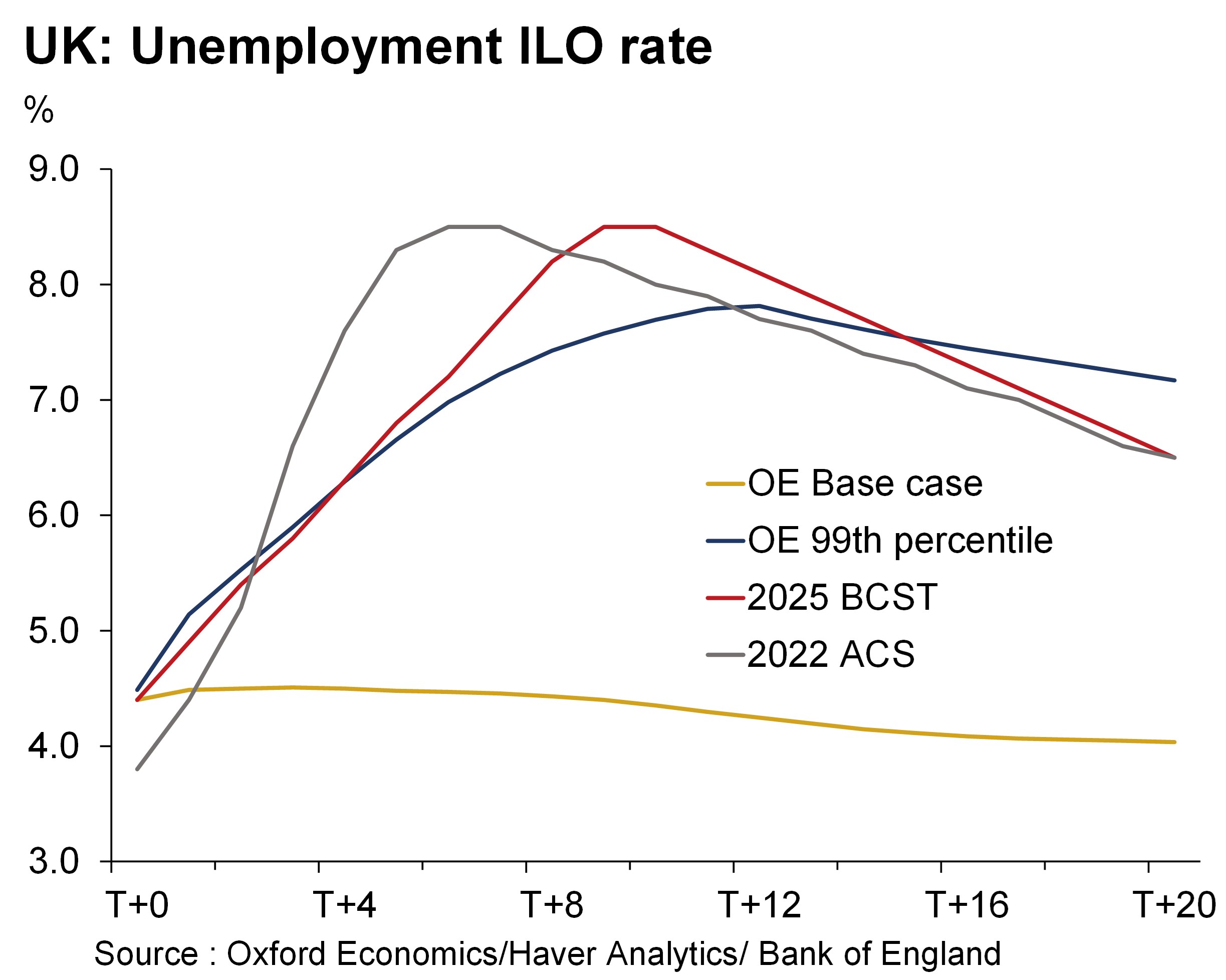

This new methodology results in the stress pathways being slightly less severe and unfolding more gradually than in previous updates of the stress test. When comparing the BoE’s updated guidance with our existing methodology for IFRS 9 scenarios, which is based on our proprietary dataset of 30-years of forecast errors, we find that the scenario projections now align even more closely. While the peak impacts observed in the BoE’s stress tests for key drivers of expected credit losses have always been broadly in line with our ‘99th percentile tail-risk scenario’, we now also observe better alignment in the build-up of the stress and the duration of the peak impacts. This supports the Bank’s additional reasoning for the update to the stress test methodology, namely, to enhance the consistency with historical experience. As our forecast-error based distributions incorporate a wide range of global downturns, such as the Global Financial Crisis and the Covid-19 pandemic, our scenario projections capture well country-specific dynamics and global repercussions from tail risk events.

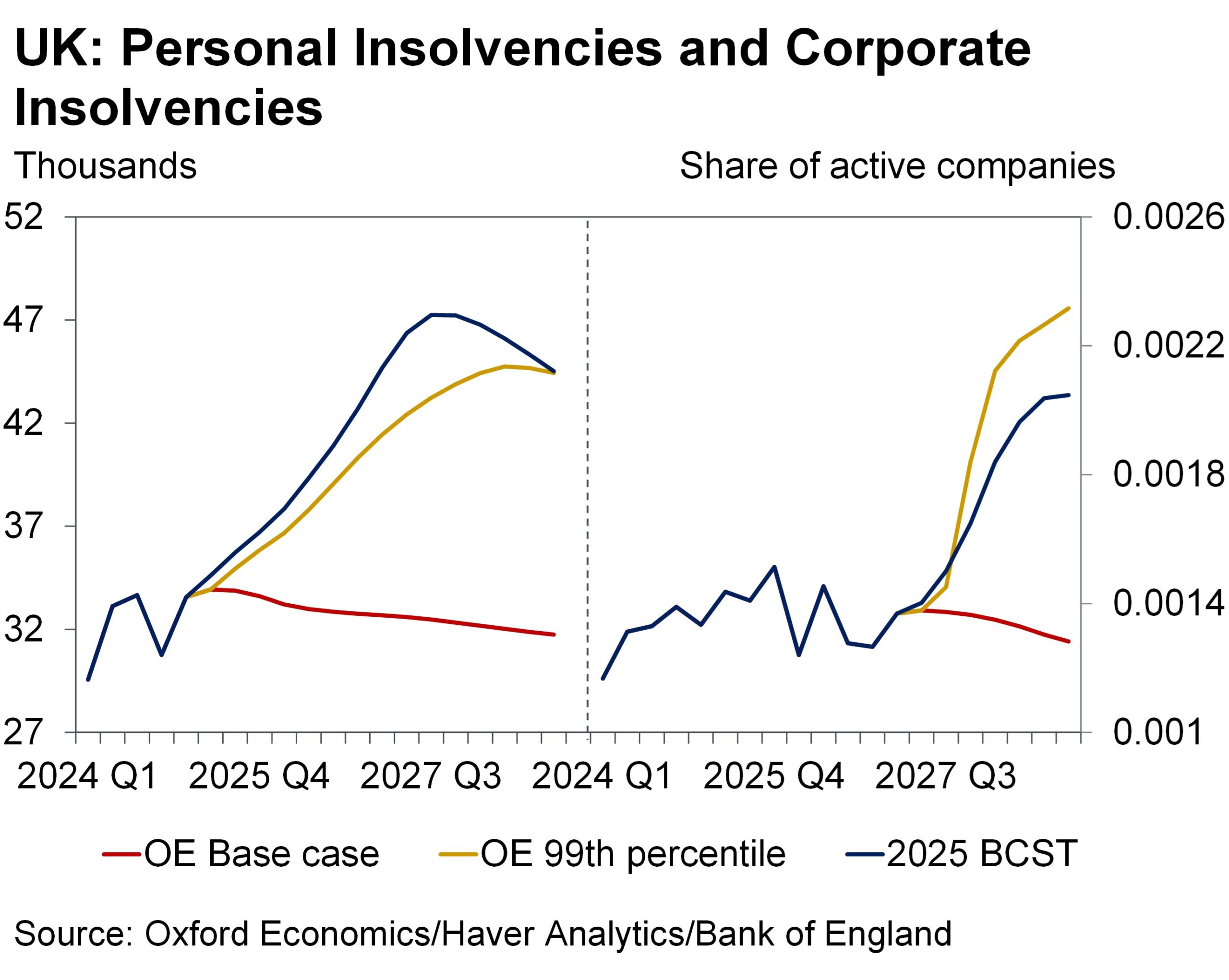

Using the Global Economic Model, we expand the BoE’s guidance to generate a fully consistent global scenario, enabling us to draw wider inferences on the impact of the updated stress test guidance. In the UK, house prices suffer an outsized start-to-trough fall of 28% in the stress scenario. This significant pressure on the housing market is compounded by a surge in unemployment and an outsized drop in households’ real income. As a result, households struggle to keep up with their debt repayments and personal insolvencies increase rapidly to levels in excess to those recorded during the Global Financial Crisis. Similarly, on the corporate side falling revenues, low confidence and tighter credit conditions lead to missed payments and higher insolvency rates, as businesses face mounting cash flow pressures and are unable to service their debts.

Since the Bank of England has shifted to carrying out the Bank Capital Stress Test only every other year, our 99th tail risk scenario enables lenders to test the resilience of their business on an ongoing bases, thus providing a dynamic benchmark to the BoE’s stress scenario. In the current environment of elevated macroeconomic volatility and rapidly evolving baseline projections, this can be a helpful additional benchmark to test the resilience to global shocks.

Click here if you want to learn more about our ‘tail-risk’ scenario and IFRS 9 service.

Subscribe to our newsletters

Tags:

Related Reports

Roadblocks to China’s chip self-sufficiency dream

China is unlikely to achieve full chip self-sufficiency any time soon because of high technological hurdles in producing advanced manufacturing equipment and materials. The self-sufficiency target now stretches well beyond actual fabrication to include the entire chip supply chain as China struggles to acquire necessary input and machinery into the production process.

Find Out More

Made in America—the manufacturing sectors with the best prospects

High-tech goods, pharma, and aerospace will be among the fastest growing segments over the next decade.

Find Out More

European defence spending surge: which sectors will benefit?

Our modelling suggests the main beneficiaries of the spending will be a highly concentrated subset of capital-intensive subsectors, mainly in transport and electronics.

Find Out More

Productive sectors remain onshore in Japan amid declining workforces

Amid the continued decline in working-age population, we expect Japan's knowledge-intensive manufacturing sectors will likely outperform other sectors. Machinery, automotive, and chemicals all require specialised know-how that are not easily replicable, and these sectors are striving to boost labour productivity through various forms of investment. The machinery sector will perform particularly well, with its share of manufacturing rising more than 1 ppt by 2035.

Find Out More