Japan’s Rising Political Instability Will Undermine Fiscal Discipline

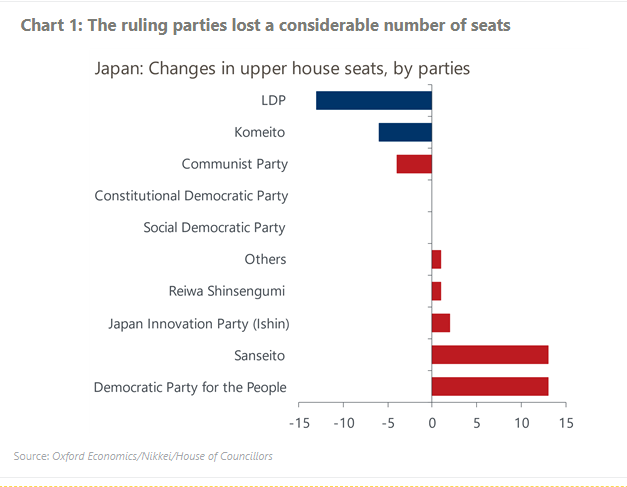

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan’s upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

In addition to persistent criticism regarding the LDP’s fundraising scandals, the opposition parties, especially small emerging parties, gained votes by campaigning for consumption tax cuts which appealed to working-age households suffering from a cost-of-living crisis. The LDP has shied away from tax cuts, arguing the consumption tax provides an essential and stable income source to pay for the ever-rising social security expenses.

Major changes in the overall economic policy framework aren’t expected. Opposition parties will demand more generous fiscal support for vulnerable households, generating upward pressure on the long-term yields. They are also more reluctant on further monetary policy normalization.

The election outcome has raised the probability of our call that the Bank of Japan will not raise its policy rate before the initial US tariff shock dissipates in late 2026. Both the ruling and opposition parties are wary of the economic consequences that high US tariffs could generate.