Research Briefing

25 Jul 2025

Why UK interest rate cuts remain a blunt tool

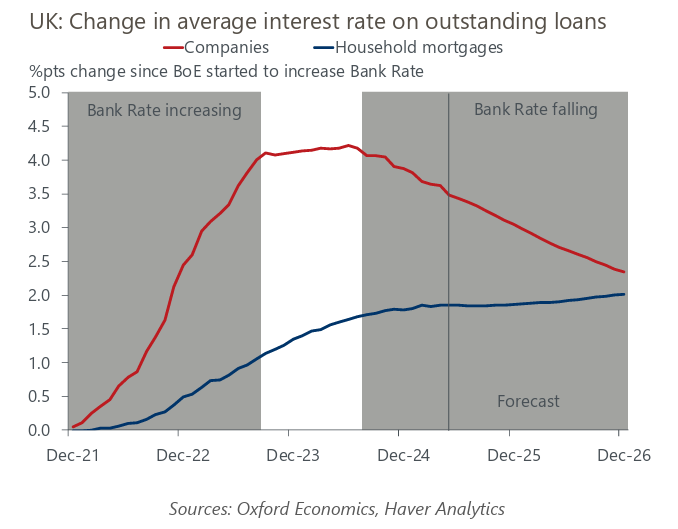

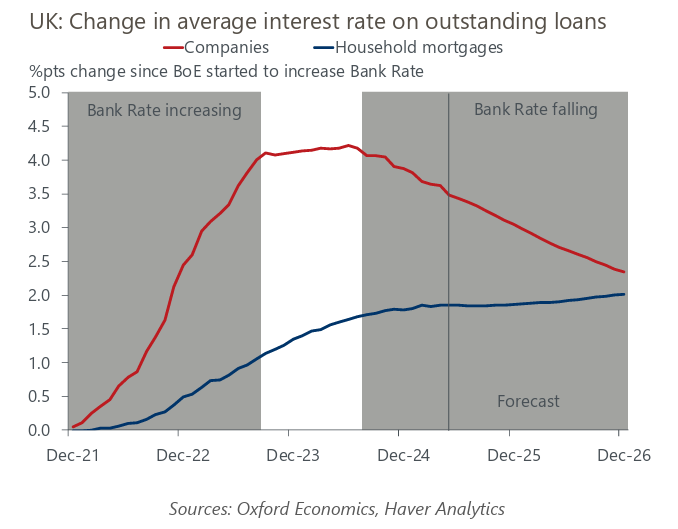

The Bank of England’s Monetary Policy Committee has delivered 100bps of rate cuts since its easing cycle began in August 2024. Although we expect the MPC to continue to gradually lower the policy rate, the lagged impact of the 2022-2024 hiking cycle is still dominating and we don’t think looser monetary policy will support an upturn in economic activity over the next couple of years.

- Although the Bank of England’s Monetary Policy Committee continues to lower Bank Rate, we expect net household interest payments to rise further as mortgagors refinance cheap fixed-rate deals. Alongside softer real pay growth and tighter fiscal policy, the lagged impact of past rate hikes on mortgagors will continue to weigh on consumer spending.

- In contrast, policy rate cuts are passing through to the corporate sector much more quickly. This should support firms’ cashflow positions and make external financing more affordable. Nevertheless, we still expect business investment to remain broadly flat given the headwinds from elevated trade policy uncertainty, sharply rising labour costs, and weak profitability.

- Bank Rate is comfortably above most plausible estimates of neutral. Given this, and our view that real activity growth is likely to remain relatively insensitive to looser policy for some time, we think this would mitigate some of the downsides to the MPC adopting a more activist approach to cutting rates than the gradual and cautious path it has pursued thus far.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]