Research Briefing

29 Jul 2025

Office rents entering growth cycle in Australia

CBD office rents set for a decade-long rebound as vacancies tighten

All the major CBD office markets across Australia are struggling with high vacancy rates (ranging from 10% to 17%) due to weak demand. Rising vacancy rates have driven leasing incentives to historically high levels, with weak or negative growth in gross effective rents across many CBD markets over the last four to five years.

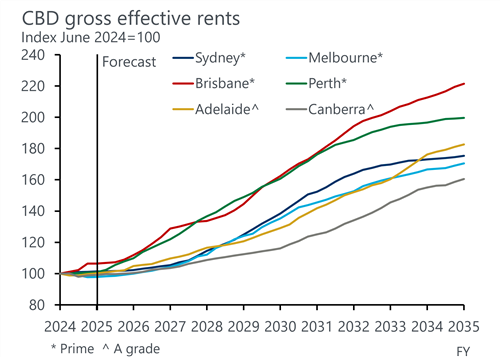

- Office property markets have long cycles with significant shifts, and effective rents are currently around the bottom of their cycle. Market conditions are forecast to be vastly different over the next 10 years, with a void of supply leading a correction that will see vacancy rates fall to more neutral settings of around 6% to 7%. This will help drive a strong upswing in effective rents to FY2035.

- Brisbane and Perth are leading the way in the current upswing with both markets seeing falls in their vacancy rates over the past 4 to 5 years, lowering their (still high) average prime leasing incentives to 38% and 43% respectively. This has underpinned 22% to 34% rises in gross effective rents with more to come over the medium to long term.

- Nationally, CBD prime or A grade gross stated rents are forecast to rise by circa 40% over the next 10 years (35% to 50% by submarket) as vacancies fall. Effective rental growth will be even higher (ranging from a 108% increase in Brisbane to 62% in Canberra Civic) as incentives normalise to 23%. This will see effective rents experience a growth cycle over the next ten years with average annual growth running at a solid 6%. This is similar to the pace of growth seen in the last upswing prior to the pandemic.

Chart 1: Rental growth prospects strongest for Brisbane

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]