Understanding the forces that drive global cotton prices

Often called “white gold”, cotton is one of the world’s most important agricultural commodities, with prices influenced by a complex web of economic, political, and environmental factors. For traders, textile manufacturers, and policymakers alike, understanding these driving forces is crucial for navigating this volatile market.

Consumer spending to drive cotton demand

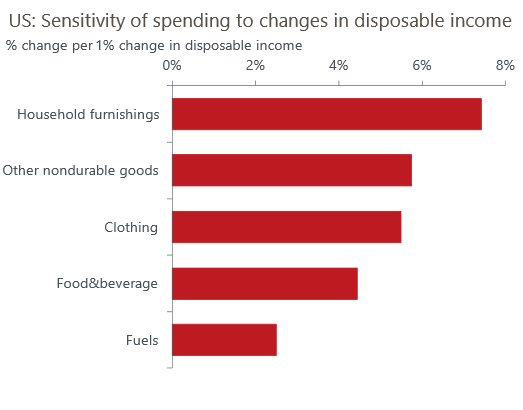

At its core, cotton demand depends on consumer purchasing power and spending patterns. Unlike essential goods, clothing are discretionary spending items, making cotton demand sensitive to changes in households’ disposable income. Our research has found that a rise of just 1% in disposable income leads to a jump of almost 6% in spending on clothes, much greater than the rise in spending on necessities like food.

Unlock exclusive economic and business insights—sign up for our newsletter today

Subscribe

Crude oil price rise slows substitution

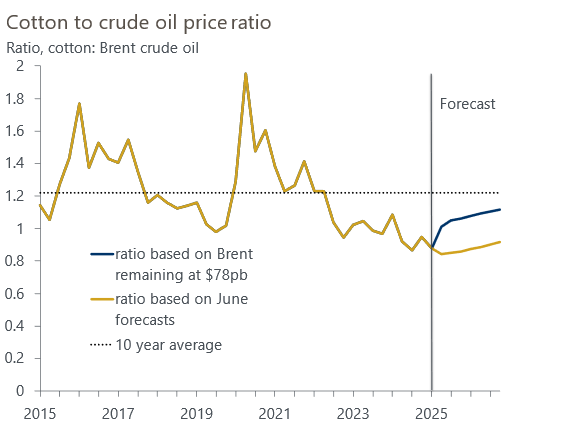

Cotton does not exist in a vacuum—it competes directly with synthetic fibres, and especially polyester. Indeed, cotton’s share of the global fibre market has fallen below 25% in recent years compared to almost 40% in the early 2000s, according to the International Cotton Advisory Committee. Polyester, the main manmade fibre, now accounts for well over half of all fibre as technological advances have improved wearability. While structural factors may boost polyester’s market share over the longer term, fluctuations in the crude oil and cotton price ratio can influence short-term dynamics.

Crude oil serves as a key feedstock for producing synthetic fibres, meaning oil price fluctuations have a direct impact on the cost of cotton’s main competitors. When oil prices rise, synthetic fibre production becomes more expensive, potentially making cotton more price-competitive and boosting its demand. Conversely, when oil prices fall, synthetic alternatives become more attractive, potentially reducing both cotton demand and prices.

The price relationship between cotton and crude oil creates a powerful dynamic that influences both market share and pricing. The cotton-to-crude oil price ratio serves as a valuable indicator for predicting shifts in fibre demand and can signal when substitution between natural and synthetic materials might accelerate. If crude oil prices were to rise, cotton demand could receive a further boost.

Shifts in supply will impact prices

Like all goods and services, the cotton market is subject to the laws of supply and demand. A strong harvest in the main suppliers, the US and China, as has been seen recently, will create excess supply, pushing prices down and enabling buyers and brokers to fill their stockrooms—indeed, global inventories are three-year highs right now.

But on top of that, planting decisions also play a crucial role in setting cotton prices. Farmers typically choose between cotton and maize based on relative expectations of price and profitability. The ratio between the two crops’ prices will influences these decisions as farmers allocate land towards the more profitable option.

Conclusion: navigating a complex risk arena

The overall message is that the global cotton price is driven by an intersection of agricultural fundamentals, global trade dynamics, consumer behaviour, and macroeconomic conditions. Understanding these interconnected factors is essential for anyone involved in cotton markets, from farmers making planting decisions to manufacturers managing supply chains.

Cotton prices are closely tied to global economic growth patterns. During periods of robust economic expansion, increased industrial activity drives demand for textiles across multiple sectors. Economic growth also supports higher employment levels and consumer confidence, both of which boost discretionary spending on clothing.

Forecasting the cotton market goes therefore beyond understanding traditional agricultural metrics and into issues such as trade, energy and global economic trends. As the world becomes increasingly interconnected, these relationships will likely become even more complex, making comprehensive market analysis more crucial than ever.

The analysis and forecasts in this blog are backed by our Global Commodity Service, which offers insights into how shifts in market fundamentals—ranging from geopolitical tensions to monetary policy easing—could shape the commodity outlook.

To make the most of our expert insights for your own analysis, request a free trial.

Subscribe to our newsletters

Tags:

Related Reports

Commodity price forecasts cut as tariffs weigh on demand

Most commodity price forecasts are cut due to tariffs except for gold and battery metals, which show resilience amid global market shifts.

Find Out More

Ukraine-Russia ceasefire changes risk profile for commodities

We assess the implications and risks for our commodity price forecasts against the backdrop of a 'fragile' ceasefire in the Russia-Ukraine conflict.

Find Out More

Trump’s tariffs on Canada would raise regional commodity prices

A blanket 25% tariff on Canadian imports to the US could have a significant impact on commodity prices, squeeze profit margins of Canadian exporters and raise prices for US end-users.

Find Out More

Trump presidency could alter the trajectory for commodity prices

Our analysis suggests that while a Harris presidency, assuming Democratic control of Congress, would have a minor positive impact on commodity prices, a Trump presidency with Republicans controlling Congress has the potential to lead to lower commodity prices.

Find Out More