Research Briefing

04 Aug 2025

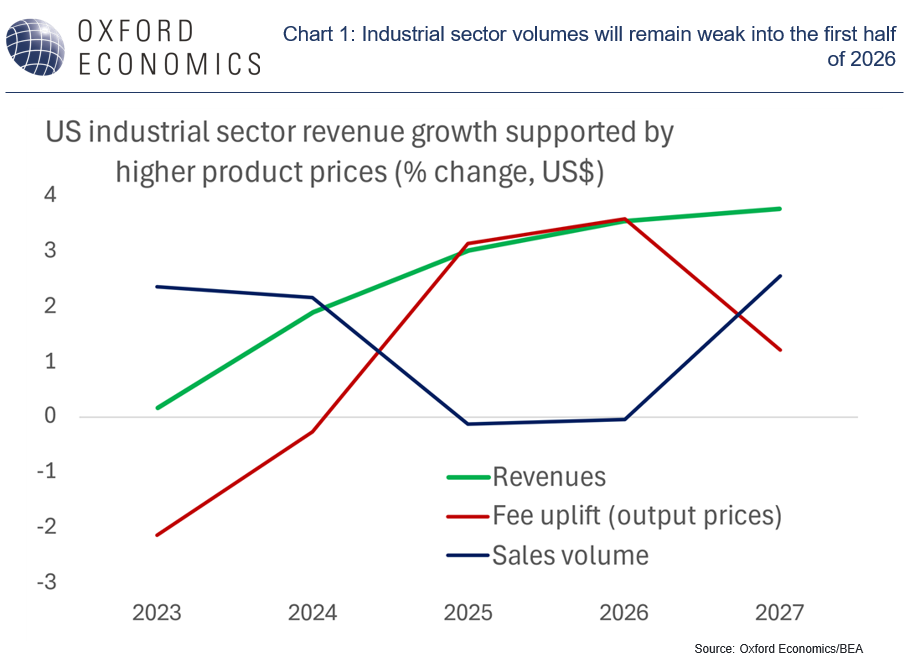

Lower US taxes help offset higher costs

The US economy will enjoy rising demand in 2026 and 2027, boosted by the recent deficit financed federal tax and spending legislation.

Revenues earned by US businesses held up very well in the first half of 2025 and we forecast they will accelerate to an average gain of 4.6% through 2027.

- Services producers will lead the gains, with 5% average revenue growth through 2027 driven by technology (9.5% in internet and data processing, 7.5% in publishing including software) and recovery in finance (banking, credit, and real estate).

- Many of the gains in business revenues are being eaten up by higher operating costs from the price of inputs, including imports and wages paid.

- Businesses’ after-tax profits and margins—often called NOPAT (net operating profits after tax)—will fare better due to friendlier tax treatment of investments, R&D, and other sector-specific costs.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]