Fresh tariffs redraw trade map

US tariff reshuffle boosts Australian and Singaporean exporters while Brazil, Turkey, and New Zealand face steeper barriers in latest trade update.

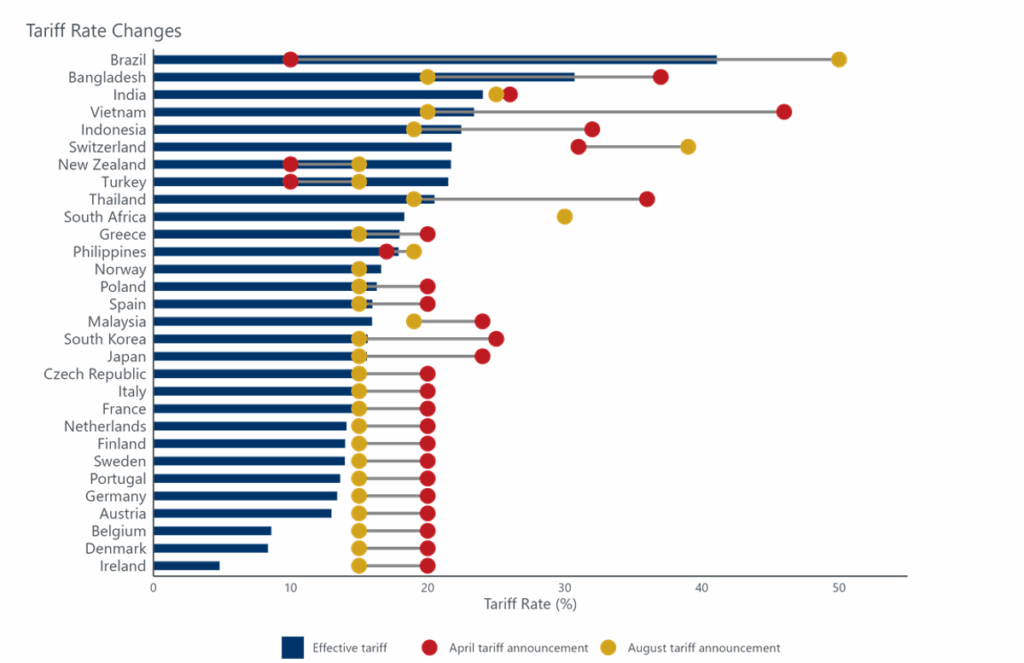

As his self-imposed deadline loomed, US President Trump delivered another round of disruptive tariff announcements on Thursday (US time). The latest executive order includes tariffs already announced in recent trade deals, those imposed from letters sent in July, and a raft of new announcements that adjust countries’ former ‘liberation day’ tariff rates. For most countries, tariffs are higher now than during the tariff pause, but lower than they were on ‘liberation day’.

- The biggest relative winners from today’s announcements are the countries that can continue to export to the US at a minimum 10% tariff rate. This includes Singapore and Australia, where tariffs on exports have remained unchanged at 10% since ‘liberation day’. Given higher tariffs faced by most other economies, businesses that ship from these countries will become relatively more competitive. That said, both Australia and Singapore were spared from higher tariffs, largely thanks to their trade deficits with the US.

- Importantly, exports from most countries still face separate sector-specific tariffs, including on steel, aluminium, copper and autos. The exceptions to this include Japan and Europe (which face lower 15% tariffs across all sectors) and the UK (with lower tariffs on auto and steel exports).

- On the flip side, the 50% tariff for Brazil makes it the biggest loser from the latest round of deals and announcements. New Zealand and Turkey also face a higher tariff than those announced on April 2. Elsewhere, effective tariffs in Bangladesh, India and Vietnam remain some of the highest in the world despite declines since liberation day.

These developments are likely to reshape the global trade outlook, influencing future import tariffs, trade tariffs, and supply chain strategies across key sectors. They may also prompt changes in HS code classifications and redefined import tax rules, increasing compliance complexity for exporters worldwide.

Chart 1: US Tariffs now lower for most countries than on liberation day