Industrial Hubs: Finding opportunity amid the challenges

Industrially intensive cities today must contend with mounting challenges, from rising geopolitical tensions and deglobalisation to the clean energy transition. The weighting of their economies towards manufacturing and extraction activities means they are more exposed to economic shocks and instability, while their high emission intensities lead to poor air quality, in turn negatively affecting health and quality of life outcomes.

Indeed, in our latest Global Cities Index, Industrial Hubs rank unfavourably across several metrics and of the eight new city archetypes we have introduced into our analysis this year, they are some of the weakest performers. Across the scores for Economics, Human Capital, Quality of Life, Environment, and Governance, they rank well below average. For the overall index score, Industrial Hubs rank in seventh place on average among the eight archetypes.

Yet these cities remain vital engines for future global economic growth, as some are set to exhibit some of the fastest rates of GDP growth across our 1,000 Global Cities. In addition, some Industrial Hubs are driving the pace of technological change—from the cutting-edge hardware powering innovations in artificial intelligence to the green technology necessary for a sustainable future.

Hence, taking a closer look at these cities shows us some of their varied weaknesses, as well as strengths. Because while current structural challenges and external forces represent significant hurdles for progress, many industrial cities continue to represent some of the strongest economic opportunities in global urban growth.

Emerging economies host the majority of the world’s Industrial Hubs

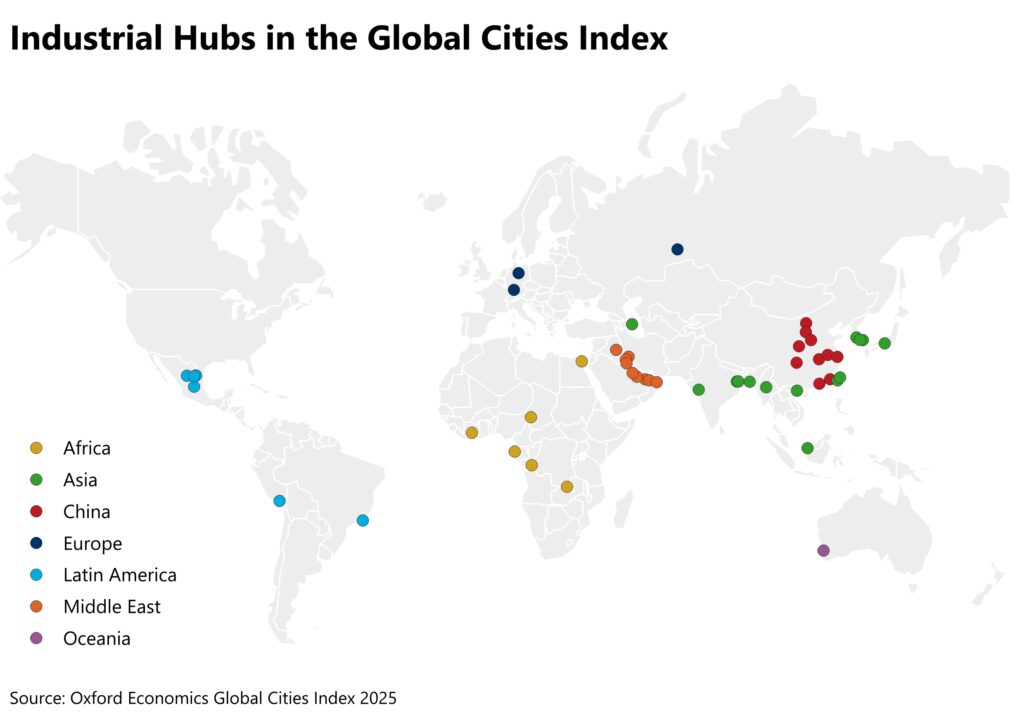

We have identified 49 Industrial Hubs among our 1,000 Global Cities. From a global perspective, what’s certainly clear among these is that they are predominantly based in emerging or developing nations. This largely reflects the traditional route of economic development, as economies typically grow through phases of industrial expansion first, before developing their higher-productivity services sectors. Just as apparent is the dominance of Asia, and especially China, which combined represent nearly half of the world’s Industrial Hubs.

It is important to note, however, that these cities may not necessarily represent all of those with the largest industrial output. The megacities of Tokyo, Seoul, and Los Angeles, for example, rank in the top 10 for total industrial output globally. But as a percentage of GDP, industrial activities for these economies account for around 10% to 20%, with the rest more broadly comprising financial, business, and public services. In comparison, the average share of industrial activity in GDP for our sample of Industrial Hubs is over 45% and is as high as 70% for Dammam in Saudi Arabia and Ahvaz in Iran.

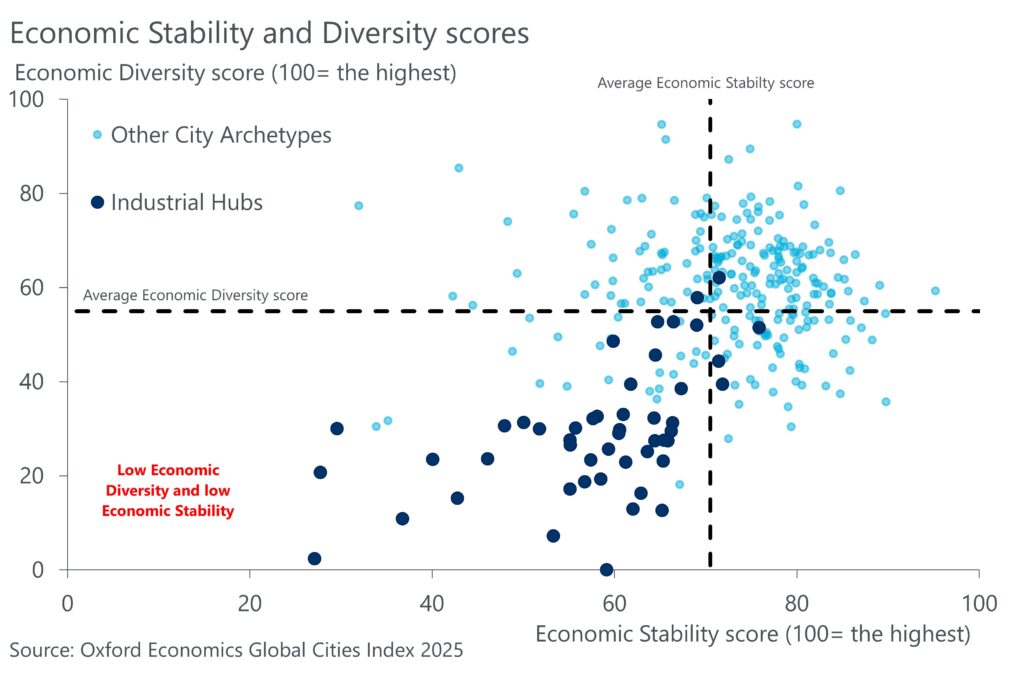

Limited economic diversity and exposure to volatility is a key weakness

A common characteristic of these Industrial Hubs, then, is their limited economic diversity. A key weakness of having an economy that is heavily weighted towards a small set of industrial sectors is greater vulnerability to economic shocks and volatility. This economic instability can mean undesirable fluctuations in inflation, risk, and investor confidence, as well as in employment and income growth. For example, resource-dependent economies, such as the Industrial Hubs in the Middle East, are highly exposed to price shocks on global commodity markets that can affect demand and production levels.

Indeed, unexpected events such as natural disasters and global conflicts can have an asymmetric impact on Industrial Hubs as they break down supply chains and elevate uncertainty. The war in Ukraine, for example, has triggered several global disruptions, from material shortages to rising costs for energy-intensive processes, which have hit industrial cities hard. In addition, the Industrial Hubs in the Middle East and Africa are more keenly exposed to national or regional political instability, which is reflected in their low scores in the Governance category of the index.

Perhaps one of the starkest examples of unexpected events unevenly affecting Industrial Hubs is the Covid-19 pandemic. Manufacturing plants were some of the first to see operations cease or slow down as the virus spread, while more broad-based city economies fared much better as office-based services continued their operations at workers’ homes. For example, in 2020, the real GDP of Berlin, Germany’s centre for finance, business services, and government fell by 3%, while in Wolfsburg, a major auto manufacturing hub, GDP was hit five times as hard (-15%).

Tariffs and escalating global trade tensions are the latest challenge

More recently, unpredictable trade policy in the United States—with tariffs imposed and rescinded at will—has left many industrial cities braced for the impact of lower global trade and greater investment uncertainty on economic growth. In the long run, it may even reshape where in the world industrial cities are, as tariffs force production to move to places less exposed to the highest rates.

The extent to which different cities are affected by specific economic shocks can vary significantly, and in the case of tariffs, we have extensively researched the range of subnational vulnerabilities across our regional cities services. In short, the impact on growth for different cities depends on the set tariff rate, the city-level industrial composition, and the degree of exposure to trade with the United States, both directly and indirectly through global supply chains.

Among the global Industrial Hubs, Mexico’s auto and steel manufacturing centres—including Monterrey, San Luis Potosí, and Saltillo—are some of the most vulnerable to tariffs given the importance of US trade to their local economies. The outlook for Chinese cities has also dimmed, as they face some of the highest rates of tariffs on their exports. Suzhou on China’s east coast is the fifth-largest city by industrial value added and is heavily dependent on the trade of electronic goods with the United States. Elsewhere, auto producers such as Nagoya in Japan (the base of Toyota), and Stuttgart in Germany (Mercedes–Benz and Porsche) will feel the pinch of targeted tariffs on their key industry, as will steel producers in South Korea.

In addition, despite not necessarily having much direct trade with the United States, extraction-dependent economies, such as Perth, and others within global supply chains could suffer because of weaker trade and industrial growth worldwide and therefore lower demand for their intermediate inputs to production.

But opportunities exist amid the challenges

Despite the risks of short-term volatility, we expect many of the world’s Industrial Hubs to represent some of the best long-term urban growth opportunities. Between 2025 and 2050 we forecast average annual GDP growth across the Industrial Hubs to reach 2.5% per year (Chart 3), topped only by the Emerging Standouts and Developing Megacities—archetypes that overlap with Industrial Hubs significantly. For example, a number of cities appear in both categories, including Surat and Bokaro in India, Kinshasa (DRC), Dhaka (Bangladesh), and Wuhan (China).

In addition, some Industrial Hubs are driving the pace of technological change and progress in global productivity. For example, Taipei and Taichung in Taiwan are two primary manufacturing and research bases for the Taiwan Semiconductor Manufacturing Company (TSMC), the leader in producing the world’s most advanced integrated circuits used for innovations in advanced computing and artificial intelligence. Industrial Hubs are also at the forefront of global advances in robotics and automation that, while certainly having important implications for labour displacement, will ultimately improve global efficiency and alleviate labour supply constraints as working-age populations age. Industrial cities in South Korea, Japan, and China are notable leaders in industrial automation, while also seeing some of the fastest ageing populations globally.

Another important challenge of global urban growth is the approach to climate change and the clean energy transition. Interestingly, while Industrial Hubs are often the worst performers in terms of environmental indicators—especially in India and Africa—some are active innovators in green industries and technology. Cities in China, for example, have adapted their industrial infrastructure to become the world’s largest producers and users of electric vehicles and hybrids. Some energy producers have even recognised the opportunities in diversifying their economies as the paths to net zero threaten the future of their traditional oil and gas sectors. This is especially the case for cities in the Middle East, which have used proceeds from their extraction activities to make enormous investments into renewable energy and services-based urban centres. Cities like Abu Dhabi have even turned their ambitions towards the future of urban development, as exemplified by Masdar City, a district of the city which has been built as a showcase for the potential of sustainable and environmentally friendly urban growth.

Certainly, some of the winds of change sweeping through the global economy are blowing against the world’s Industrial Hubs. Escalating global trade tensions have created an uncertain and challenging environment for global industry and exposed industrially intensive cities to their key economic vulnerabilities. Yet from the industrial revolution to globalisation and digital automation, Industrial Hubs have been vital in the world’s economic and technological progress, and they remain so today.

In this webinar, our panel of experts outlined the key results from this year’s update and discussed major trends impacting cities around the world—from AI to trade wars to climate change.

The Oxford Economics Global Cities Index ranks the largest 1,000 cities in the world based on five categories: Economics, Human Capital, Quality of Life, Environment and Governance. Underpinned by Oxford Economics’ Global Cities Service, the index provides a consistent framework for assessing the strengths and weaknesses of urban economies across a total of 27 indicators. To our knowledge, this is the largest and most detailed cities index in the industry. To download the full report, please fill out the form below.

Tags:

Related Reports

A region of expansion and inequality: The highs and lows of Southern Asian cities

Our Global Cities Index shows that whilst Southern Asian cities do not top the overall rankings, they are important global players, with particularly strong economic performance.

Find Out More

Legacy cities: historic centres that must relearn lessons in growth

Although each legacy city confronts distinct obstacles, they also possess distinctive strengths that can be harnessed for success in today's world. The Global Cities Index reveals that these cities can study successful examples and apply those insights to develop effective approaches for thriving in our fast-evolving global landscape.

Find Out More

Tariffs and tensions are reshaping city economies

Tariff policies, rising geopolitical tensions and unprecedented uncertainty are putting pressure on cities and regions across the world.

Find Out More

The virtuous cycle of culture and prosperity in the world’s cities

Despite its breadth and intangibility, the impact of culture is revealed through our in-depth analysis of global city economies, and the fact that almost half of the world’s top 50 cities in this year’s Global Cities Index are in fact, Cultural Capitals.

Find Out More