Research Briefing

06 Aug 2025

Households open their wallets as an August rate cut looms in Australia

Stronger Q2 household spending masks underlying softness, reinforcing expectations for RBA easing

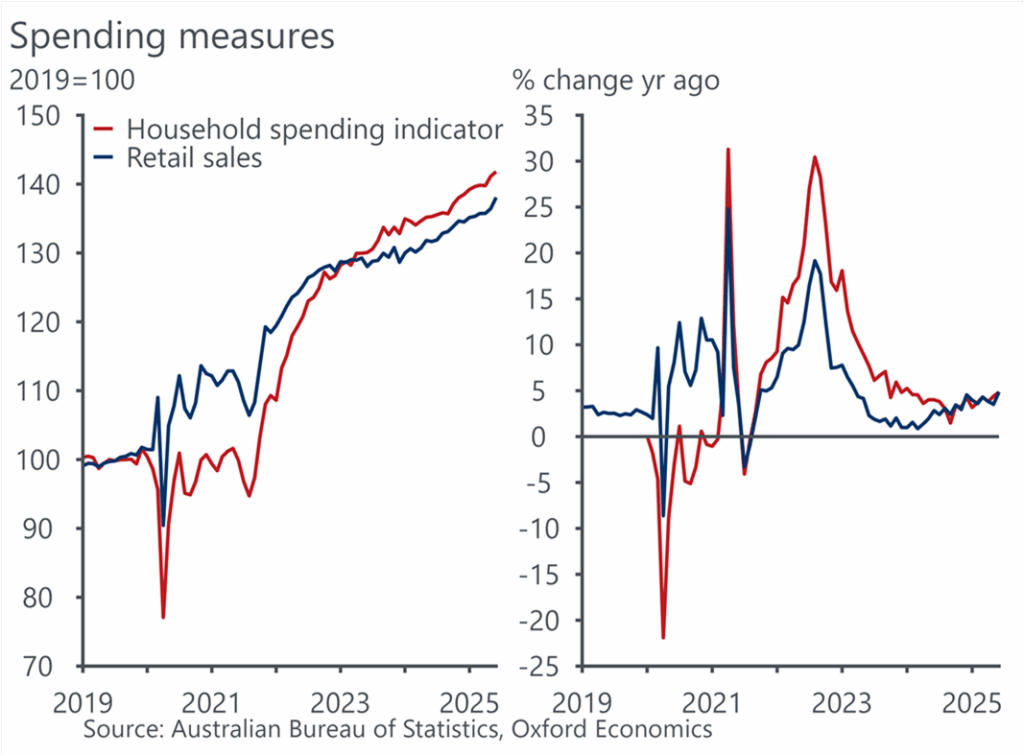

The monthly household spending indicator (MHSI) rose 0.5% m/m in June, building on a 1% m/m surge in May. The jump in June was driven by food, vehicle and electronics purchases, spurred by end-of-financial-year discounting.

- The MHSI suggests consumer spending was stronger in Q2 than the signal received from the narrower retail sales measure; retail sales volumes declined in Q2, but the measure including services increased 0.7% q/q, and 0.3% q/q in per capita terms.

- The Q2 MHSI suggests household spending growth has picked up a little. But, per capita growth is still subdued. Coupled with a softening labour market and easing inflation, we still expect the RBA to cut the cash rate at the August meeting, with another cut likely in Q4.

Chart 1: Household spending jumps again in June

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]