Five lessons for businesses navigating tariffs and trade turmoil

There’s no shortage of experts telling firms to diversify their supply chains: “Move away from the US” or “develop a China+1 strategy.” Sure, that’s useful advice. But it’s not achievable for every business. In fact, it’s not achievable for most. It costs a mountain of money to find new suppliers, test products, and build relationships with manufacturers. Suggestions that firms can simply “diversify” are too simplistic. But that doesn’t mean firms should sit still. There’s plenty that can be done now that won’t break the bank.

1. Know your exposures

You don’t have to diversify your supply chains to understand your vulnerabilities. Map your suppliers, your markets, and your key inputs. Who do you rely on most? Which markets are most exposed to tariffs, or trade disruptions?

For instance, our TradePrism data shows Vietnam is a major importer of semiconductors, with much of that used in the manufacture of consumer goods headed for the US. If US-Vietnam tensions escalate, we could see part of this trade drop, denting Vietnamese demand for semiconductor inputs. As Vietnam’s major supplier of semiconductors, firms in Hong Kong, China, Korea, Singapore, Malaysia and Japan are exposed to the winds of upstream trade disputes.

Speak with our trade experts to discuss how these trends impact your business.

Get in touch

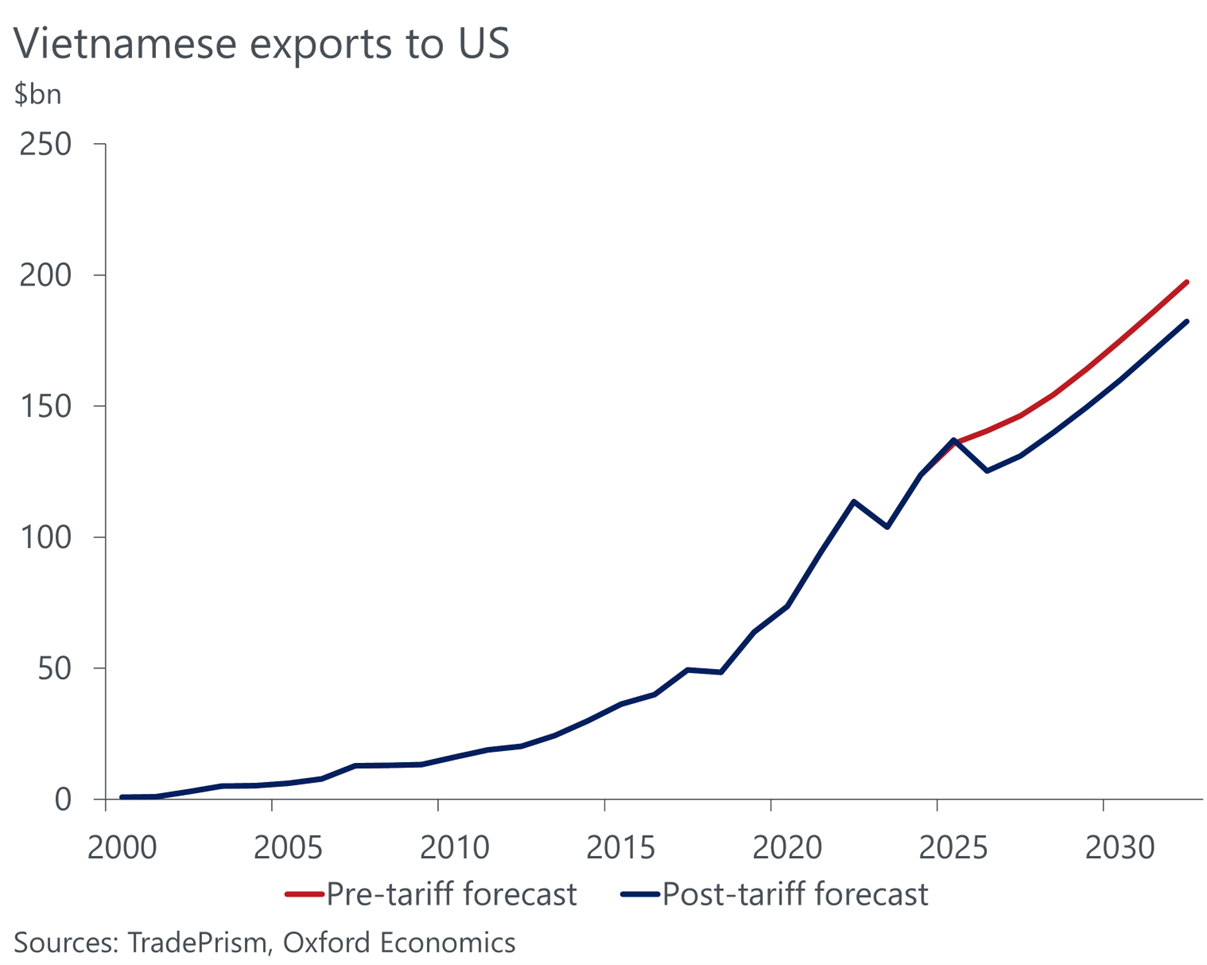

A further deterioration is not unthinkable, particularly as US officials crack down on transhipments – with Vietnam under particular scrutiny given trade gains since 2016. If that were to happen, we could see Vietnam-US trade fall even further; already, we forecast Vietnamese exports to the US to drop around 9% next year on the back of higher tariffs, and weaker demand.

Consider indirect effects too. US tariffs on steel and copper, for example, can ripple through global markets, hitting input costs even for firms that don’t export to the US. Many businesses don’t fully appreciate how complex their supplier networks are until something breaks – and by then, it’s too late.

2. Identify opportunities

Trade disruptions don’t just create losers; they can create openings. Where are competitors’ costs likely to rise due to tariffs. Does that create opportunities to enter new markets?

If you’re an exporter, build relationships in those markets now. Even if you can’t shift volumes immediately, you’ll be better placed to pivot when the opportunity arises.

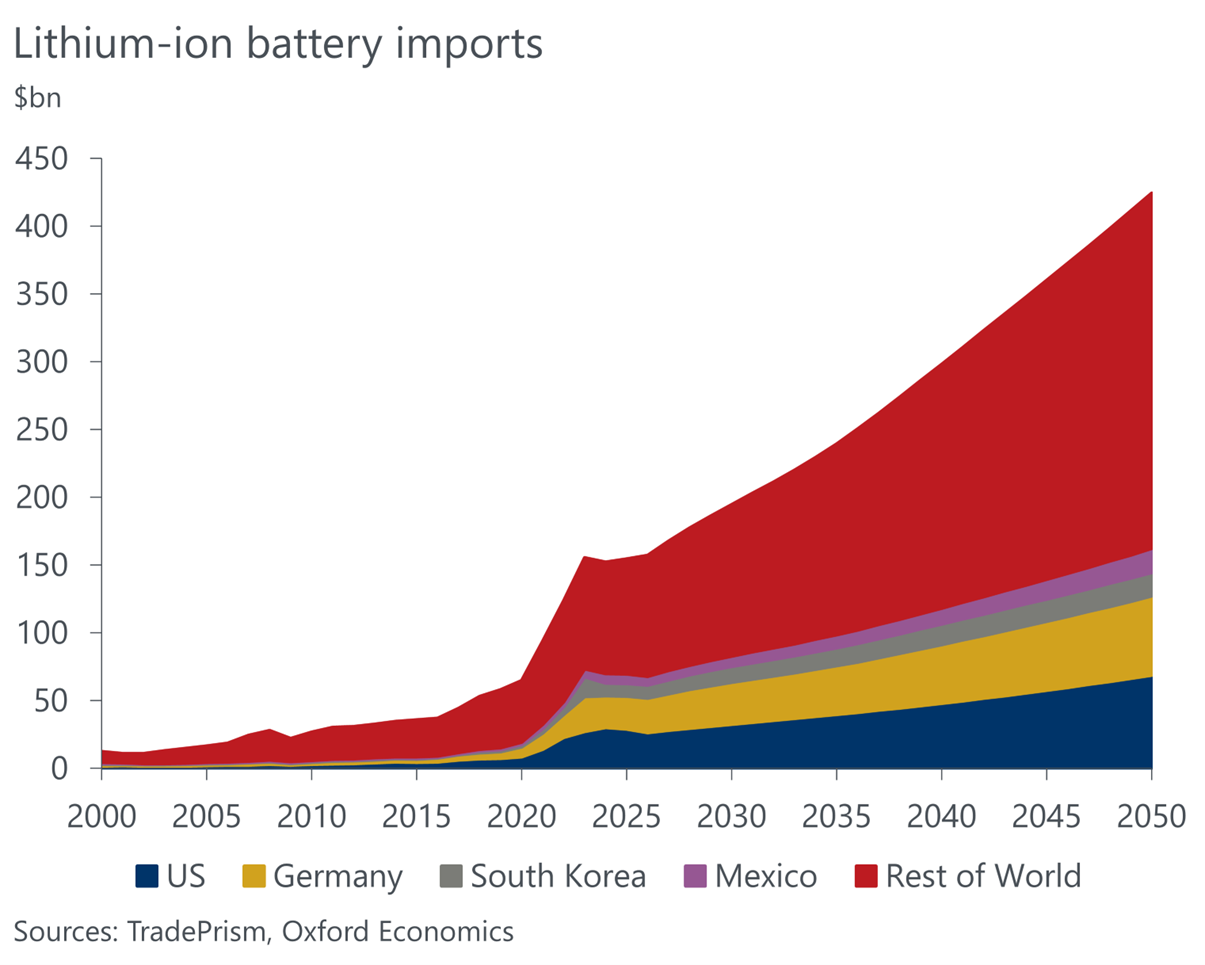

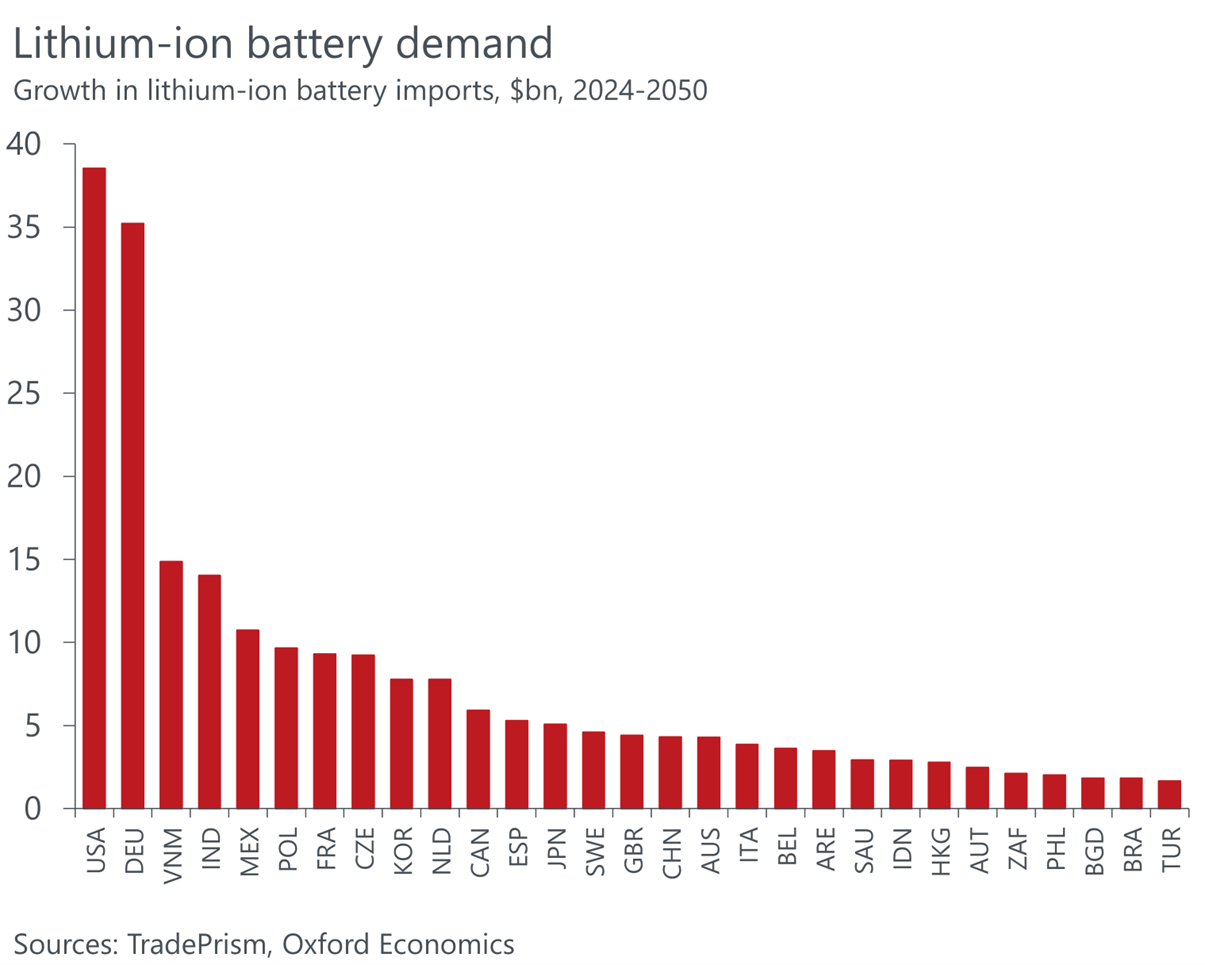

Our detailed 4-digit HS code forecasts show where these growth areas are. For instance, chart 3 shows projected demand for lithium-ion batteries to 2050. Importantly, the bulk of that growth is expected to be driven by countries not currently in the top handful of importers.

Why? Well, changing industry structures and economic growth mean economies like

Vietnam, India and Poland will need more and more batteries – both as inputs into manufacturing and to power their economies. Being ahead of the curve in identifying these dynamics allows firms to make moves now, establishing ties in the economies with the fastest-growing demand. Don’t wait for others to get in first.

3. Rethink competitive dynamics

Today’s best deal may not be tomorrow’s. Tariffs flip competitiveness on its head. Suppliers you’ve long assumed were the cheapest may suddenly be undercut by competitors from lower-tariff markets. Conversely, suppliers in the direct line of fire may be forced to discount heavily to hold onto business. This could create opportunities to switch suppliers and lock in lower input costs.

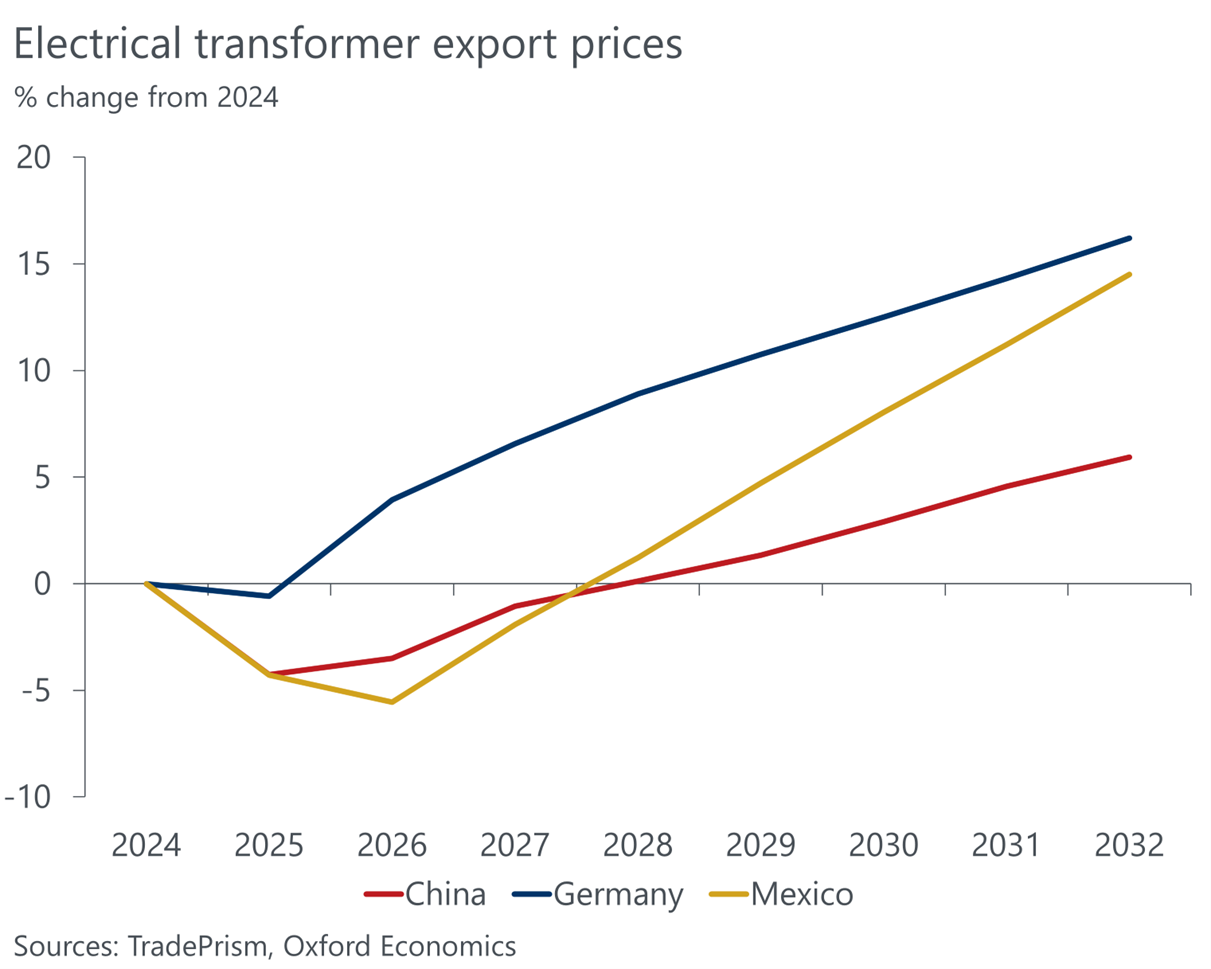

Take electrical transformers, for example. Chart 4 shows the change in export prices for the three largest exporters of electrical transformers. Two of them – China and Mexico – are in the crosshairs for President Trump’s tariffs. As US demand dries up, manufacturers in these economies will need to cut prices to stay competitive and break into new markets. Meanwhile, German export prices are more insulated, aided by relatively lower US tariffs; still, the 15% duty on EU exports is enough to see prices effectively flatline this year. As import tariffs on Mexico come down through the second half of 2026, growth in electrical transformer export prices will outpace those from China; we expect US tariffs on imports from China to stay elevated indefinitely.

Electrical transformers are key inputs into the manufacture of battery systems, consumer electronics, computers and industrial equipment. Finding cheaper suppliers can save manufacturers of these types of goods a pretty penny.

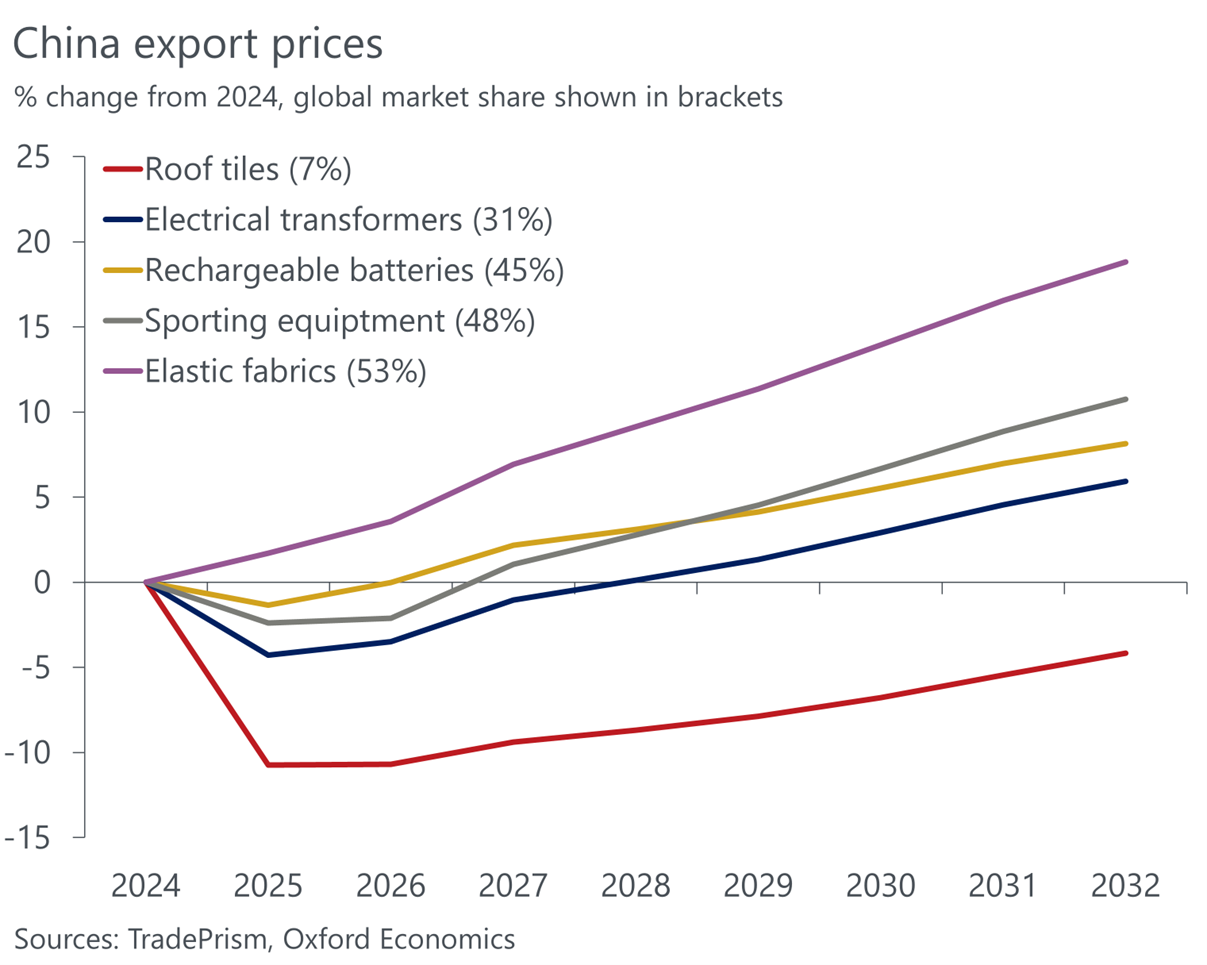

These types of price dynamics play out across the entire trade map. But the shifts are not linear. For goods for which China has a larger market share, prices are stickier. For instance, China accounts for more than half the world’s export of elastic fabrics (think spandex and Lycra). Given China’s dominance (and the world’s lack of alternative suppliers), prices are still able to rise this year and next, despite tariffs. In contrast, China is only a minor player in the roof tile exports, meaning US buyers have more options to find cheaper suppliers. As buyers look elsewhere, prices are expected to fall more than 10% this year.

4. Leverage trade agreements

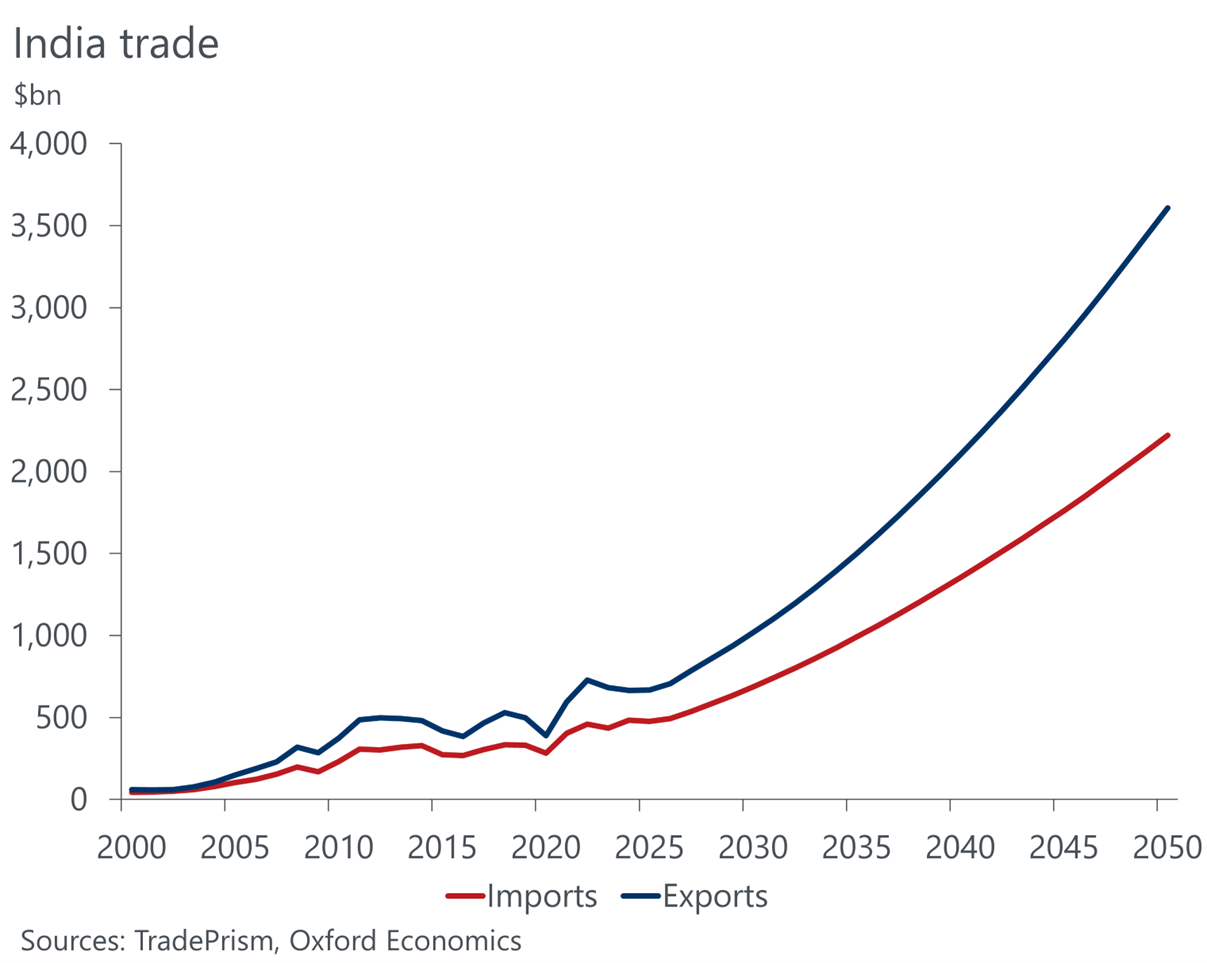

While the US raises barriers, other countries are opening doors. In July, the UK and India struck a wide-ranging trade deal. India is also negotiating with the EU and Australia on expanded deals expected to be signed later this year.

These agreements can lower supplier costs and open new markets for your products. Do the work to understand how your business can benefit. Would a new agreement make it cheaper to source from a particular country? Could it help you reach customers you couldn’t before?

5. There are certainties in uncertain times

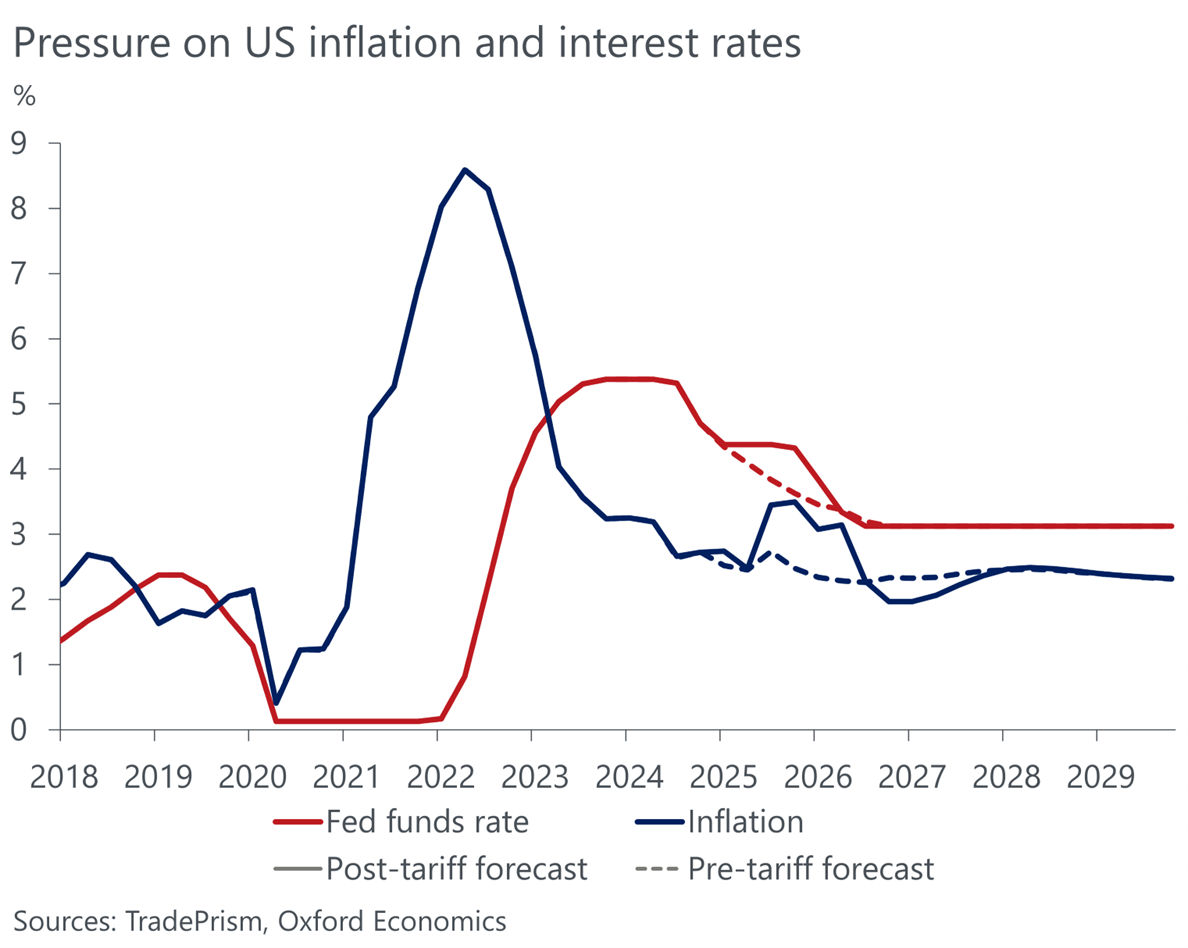

Uncertainty can be paralysing, but some outcomes are predictable. Tariffs are inflationary for the economy that imposes them. Big spending programs like Trump’s One Big Beautiful Bill also add to price pressures. That means higher inflation and elevated interest rates in the US this year. Another certainty? Markets seek safe havens during chaos. Usually, that’s the US dollar. However, with political interference in key US institutions – from the Federal Reserve to the Bureau of Labor Statistics – investors are looking elsewhere. That will likely push the greenback lower over time. Sticky US rates and a softer US dollar can create opportunities to hedge currency exposures and take advantage of interest rate differentials. Our forecasts are rooted in economics, helping businesses identify opportunities and risks beyond just trade.

The bottom line

The global trade environment is volatile and politically charged. But businesses don’t have to be paralysed.

By knowing your exposures, scanning for opportunities, reassessing competitive dynamics, leveraging trade agreements, and acting on economic certainties, firms can move decisively – even when the world is turbulent.

For the latest reports on trade and tariffs, please visit our topic page.

Join our upcoming webinar to stay updated on the evolving landscape of US trade policy and get your questions answered by industry experts.

Want to deepen your understanding of how trade tariffs and HS codes impact global trade? Read our comprehensive guide here.

Interested in the forces shaping the future of trade? Read our latest blog for expert insights.

Related content

Trade tracker – Tariff impacts continue to build

US tariff rates are climbing to levels not seen since the 1930s, with world trade expected to decline and inflation set to rise. What could this mean for global markets and economic growth?

Find Out More

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

US tariffs and the uneven impact across cities in Europe and Asia

The latest US tariffs are reshaping global trade patterns, hitting some cities harder than others. From Germany’s auto hubs to China’s electronics exporters, which regions will weather the storm and which will struggle?

Find Out More

The Future of Trade: Tariffs, Taxes, and Economic Trends

Amid ongoing global trade uncertainty, business leaders are struggling to plan ahead as new tariffs continue to reshape the market. Even so-called “locked-in” tariffs are proving to be temporary, adding to the unpredictability. Firms are cautious, waiting for clarity before committing to major investments. As global trade volumes decline, the importance of understanding every relevant trade tariff and accurately applying the correct HS code to imported goods becomes even more critical for managing costs and compliance.

Find Out More

Fresh tariffs redraw trade map

Trump’s latest tariffs favour Australia and Singapore with unchanged 10% rates, while Brazil faces a sharp 50% hike. India, Vietnam, and Bangladesh continue to face some of the world’s highest effective tariffs despite recent declines.

Find Out More

Tariffs bite as August deadline looms

Research Briefing Five lessons for businesses navigating tariffs and trade turmoil Trade tensions escalate as new tariffs and policy uncertainty trigger sharp downturn in global shipping activity

Find Out More

Last-minute trade deal with the US leaves Eurozone outlook unchanged

We don't plan material changes to our Eurozone baseline forecast of 1.1% GDP growth this year and 0.8% in 2026 in response to the EU-US trade deal.

Find Out More

What are tariffs good for?

We built a forward-looking framework for analyzing how US tariffs achieve or undermine the various goals touted by policymakers.

Find Out MoreTags: