A region of expansion and inequality: The highs and lows of Southern Asian cities

Southern Asia, a region spanning 16 countries from Afghanistan to Indonesia, is a diverse and fast-growing region home to almost one-third of the world’s population and growing rapidly. The importance of the region can be seen in our Global Cities Index, which covers 171 cities across Southern Asia and is home to 40% of all megacities worldwide—the highest proportion out of all regions—with six in India alone and two more expected by 2050. As these emerging cities continue to develop, many are shifting toward more productive economic sectors, particularly services. This transition holds the potential to increase prosperity and improve living standards for local populations. However, the benefits have yet to be fully realised and many cities still grapple with the challenges of rapid economic growth, including poor living conditions and unsustainable environmental outcomes.

Over the past century, Southern Asian economies have emerged from colonial rule, navigated conflict and political instability, and are now beginning to reap the benefits of their independence. Yet, as is typical with the emerging stage of economic development, this volatility and fast growth has made space for inequality between and within local regions and cities. Addressing these disparities is essential to sustaining progress. Without meaningful action, inequality risks undermining development by limiting access to opportunity and enabling corruption. By harnessing their strengths and working on their weaknesses, Southern Asian cities can continue on their path of becoming major global powerhouses.

The highs

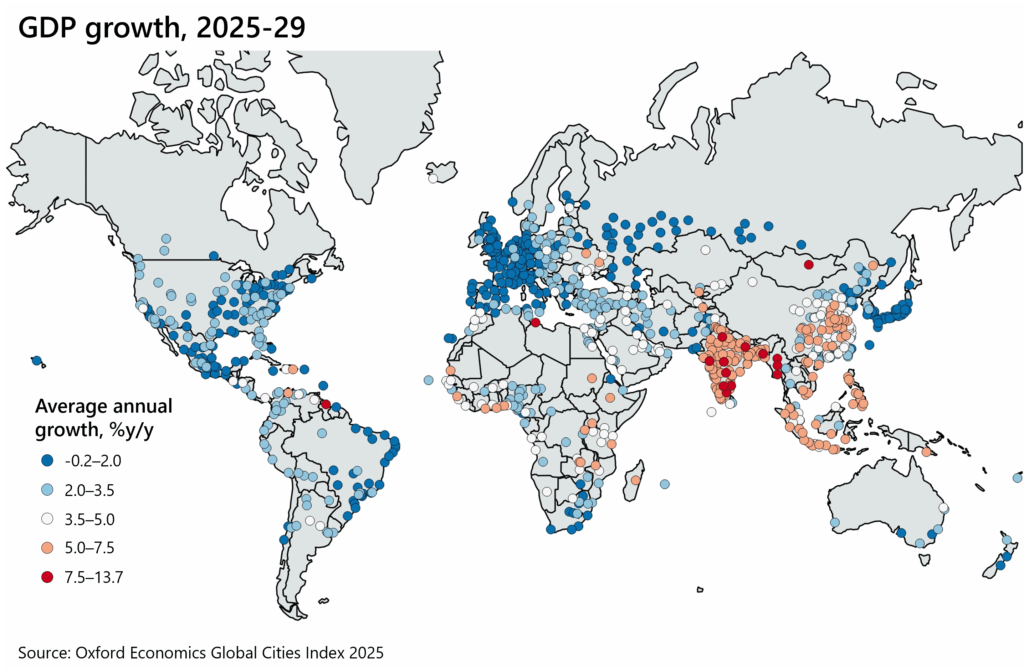

The Global Cities Index measures the success of the world’s 1,000 largest cities across five categories—Economics, Human Capital, Quality of Life, Environment, and Governance. It is without doubt that Southern Asian cities perform best in the Economics category as the cities dominate our medium-term GDP growth ranking, and we expect that 46 of the 50 fastest growing cities between 2025 and 2029 will be in Southern Asia. For many of these fast-growing cities in India, Vietnam, and the Philippines, impressive expansion of their services-based sectors such as IT and professional services is the main driver of this growth—with cities such as Bengaluru and Hyderabad expected to grow by almost 9% on average each year.

Chart 1: Southern Asian cities dominate medium-term GDP growth rankings

Whilst some Southern Asian cities do not make the Global Cities Index’s top 50 for 2025–2029 GDP growth rankings, they do perform well in other indicators under the Economics category such as economic stability. For example, over the decade before Covid-19, Indonesian cities grew on average by just over 5% a year, and for almost three quarters of these cities, GDP growth remained within 1 percentage point of this average. This consistency can be partly attributed to the Indonesian government’s national strategy of prioritising stability by keeping the current account deficit and government debt under control. Indeed, Indonesia’s cities also score well for political stability and institutions.

However, it is not only the Economics Category where Southern Asian cities excel; some cities also perform well for Quality of Life. For example, Singapore ranks fourth place overall in this category. Indeed, the city just misses out on top 10 status for low crime rates, ranking 11th globally, and at the same time, has strong scores for income per person and life expectancy. It is no surprise that Singapore stands out as Southern Asia’s highest ranked city overall, coming in 21 out of 1,000 globally. This city has placed itself as a global transshipment hub, connecting the region with the rest of the world, as well as strengthening its attractiveness as an international, university city with many international corporate headquarters. All these factors have advanced employment opportunities and standards of living for the city’s population.

The lows

Whilst many Southern Asian cities, particularly across India and Indonesia, rank highly on certain indicators, in general cities across the region underperform overall in our Global Cities Index. Indeed, although many Southern Asian cities have strong GDP growth, few find themselves in the top 50 for GDP size (only Singapore and Jakarta). Cities across India, the Philippines, and Indonesia are in fact ranked in the bottom 100 for GDP size. Therefore, although growth is strong across the region, this growth is coming from a low base and deprivation remains a central issue.

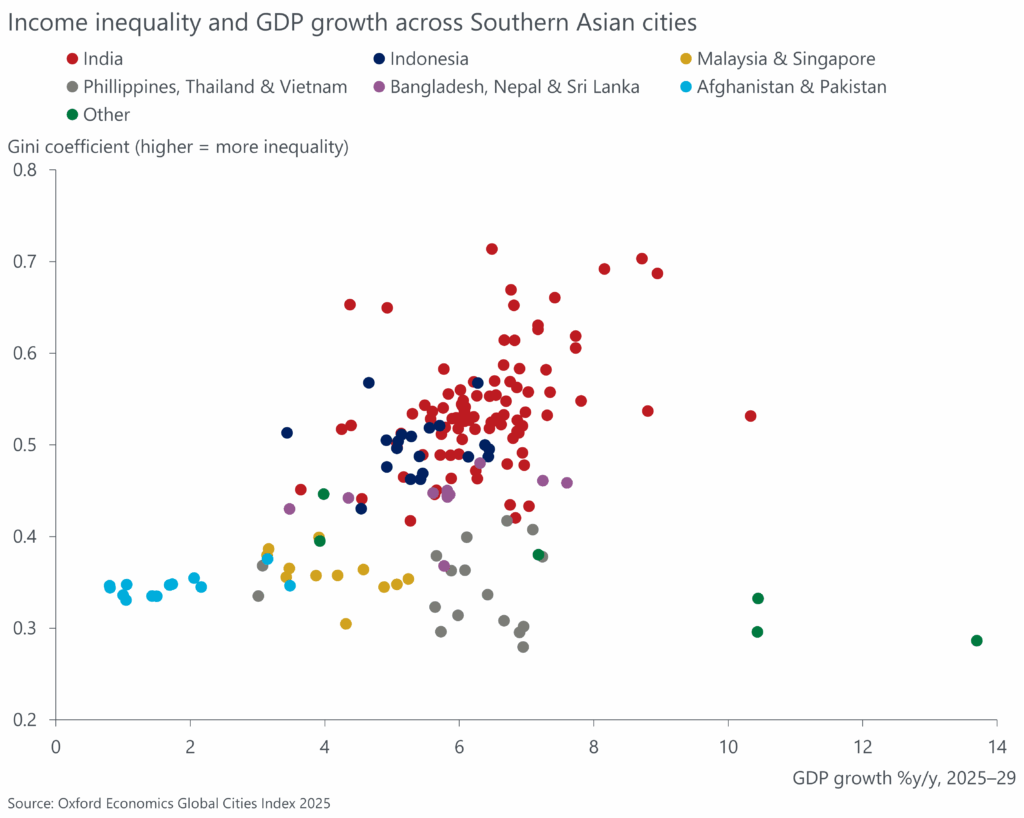

GDP per capita across Southern Asia, a measure of living standards, paints a similarly weak picture with 96% of the region’s cities in the bottom half of the pack and Indian cities disproportionately featured. In fact, three-quarters of India’s cities are ranked in the bottom 100 for income inequality, and India’s fastest three growing cities are ranked in the bottom five— alongside Mumbai and Indore. This is important as income inequality can have many consequences for a local economy, including worse health outcomes, high poverty and crime rates, and unequal economic opportunities. However, it is important to note that income inequality is a typical characteristic of emerging economies (not exclusively a Southern Asian phenomenon) as some city residents benefit from higher paid work in more skilled, productive service sectors, whilst others remain in lower paid manufacturing work for the time being.

Chart 2: Cities in India have faster medium-term growth forecasts but lower income equality than the rest of the region

Improving the general performance of Southern Asia cities in the Human Capital Category is important as one factor that is restricting the earnings potential of residents—and potentially perpetuating income inequality—is low education levels. Education attainment scores are relatively low across the region, but particularly in cities across India and the Philippines. Fewer years of schooling are restricting the education qualifications and therefore employment opportunities of local populations. More education would allow more people to enter higher–valued and productive service sector work with higher wages.

Finally, and perhaps of even more importance, is improving the overall scores for the Environment category. In particular, for a region with such strong growth prospects, the sustainability and longevity of its cities’ successes is vital. Unfortunately, Southern Asian cities score particularly poorly for air quality— indeed, half of the worst 100 ranked cities for this indicator are in Southern Asia with Indian cities dominating the space. This is a result of the accumulation of population and traffic pressures, factory emissions, extreme weather conditions, and the common use of dirty fuels for energy. Environmental risks are an important consideration as they can restrict and influence all the other categories in the Global Cities Index i.e., restricting economic output and worsening Human Capital and Quality of Life outcomes.

Conclusion: Walking towards equality

Our Global Cities Index shows that whilst Southern Asian cities do not top the overall rankings, they are important global players, with particularly strong economic performance. The current challenge that the region and its cities are facing, especially in India, is income inequality, which is important to manage as it can have many adverse effects for local populations. However, the transition from emerging economies to advanced takes time and as GDP growth continues to outpace population growth across these cities, consumer markets and quality of life should grow.

In this webinar, our panel of experts outlined the key results from this year’s update and discussed major trends impacting cities around the world—from AI to trade wars to climate change.

The Oxford Economics Global Cities Index ranks the largest 1,000 cities in the world based on five categories: Economics, Human Capital, Quality of Life, Environment and Governance. Underpinned by Oxford Economics’ Global Cities Service, the index provides a consistent framework for assessing the strengths and weaknesses of urban economies across a total of 27 indicators. To our knowledge, this is the largest and most detailed cities index in the industry. To download the full report, please fill out the form below.

Tags:

Related Reports

Industrial Hubs: Finding opportunity amid the challenges

Although each legacy city confronts distinct obstacles, they also possess distinctive strengths that can be harnessed for success in today's world. The Global Cities Index reveals that these cities can study successful examples and apply those insights to develop effective approaches for thriving in our fast-evolving global landscape.

Find Out More

Legacy cities: historic centres that must relearn lessons in growth

Although each legacy city confronts distinct obstacles, they also possess distinctive strengths that can be harnessed for success in today's world. The Global Cities Index reveals that these cities can study successful examples and apply those insights to develop effective approaches for thriving in our fast-evolving global landscape.

Find Out More

Tariffs and tensions are reshaping city economies

Tariff policies, rising geopolitical tensions and unprecedented uncertainty are putting pressure on cities and regions across the world.

Find Out More

The virtuous cycle of culture and prosperity in the world’s cities

Despite its breadth and intangibility, the impact of culture is revealed through our in-depth analysis of global city economies, and the fact that almost half of the world’s top 50 cities in this year’s Global Cities Index are in fact, Cultural Capitals.

Find Out More