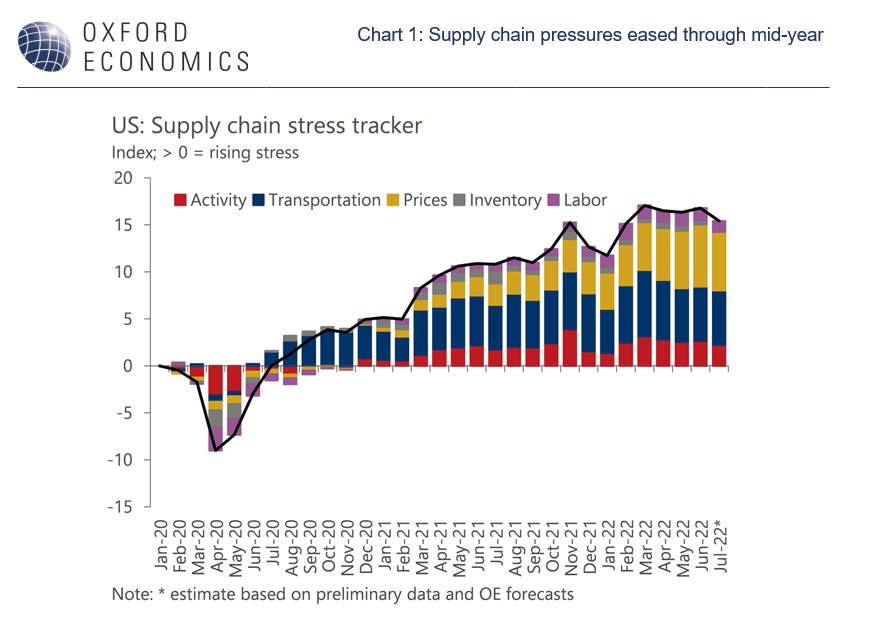

Improving supply chain conditions kick off H2 in the US

Supply-chain conditions in the US offered encouraging signs to start Q3, according to our supply chain tracker. Inflationary pressures ebbed and logistics challenges eased. Labor market dynamics improved while inventories maintained their ascent. Cooler activity resulted in a healthier balance between demand and supply.

What you will learn:

- Commodity prices declined 8% on average in July, and regional Fed and ISM surveys signaled lower price pressures. Costs will remain high in H2 2022, but we should see inflation prints start to come down as demand begins to align with supply.

-

Cargo ship backlogs in Southern California declined for the sixth straight month, and other modes of transport also signaled reduced stress. Shipping prices were flat or fell. Conditions are improving, but geopolitical risks continue to cast a shadow over logistics.

-

Labor market conditions were heartening as the economy created a robust 528k jobs, and overtime hours fell again. We look for reduced consumer demand, high costs, and lower profitability to bring worker demand and supply into greater equilibrium.

Tags:

Related Services

Post

US supply-chain stress eases as front-loading pressures fade

The reversal of tariff-related front-loading pressures continues to offer relief to our supply-chain stress index.

Find Out More

Post

US Medicaid cuts will hit some states harder than others

Millions are expected to lose coverage due to new eligibility rules and the expiration of premium subsidies.

Find Out More

Post

Bifurcated – How the US economy is splitting

The US economy has slowed and become bifurcated across consumers, the business environment and the labor market.

Find Out More