Recent Release | 11 Oct 2022

The Economic Impact of Buy Now Pay Later in Australia

Economic Consulting Team

Oxford Economics

Oxford Economics was commissioned to measure the economic impact of Buy Now, Pay Later (BNPL) in Australia by the Australian Finance Industry Association.

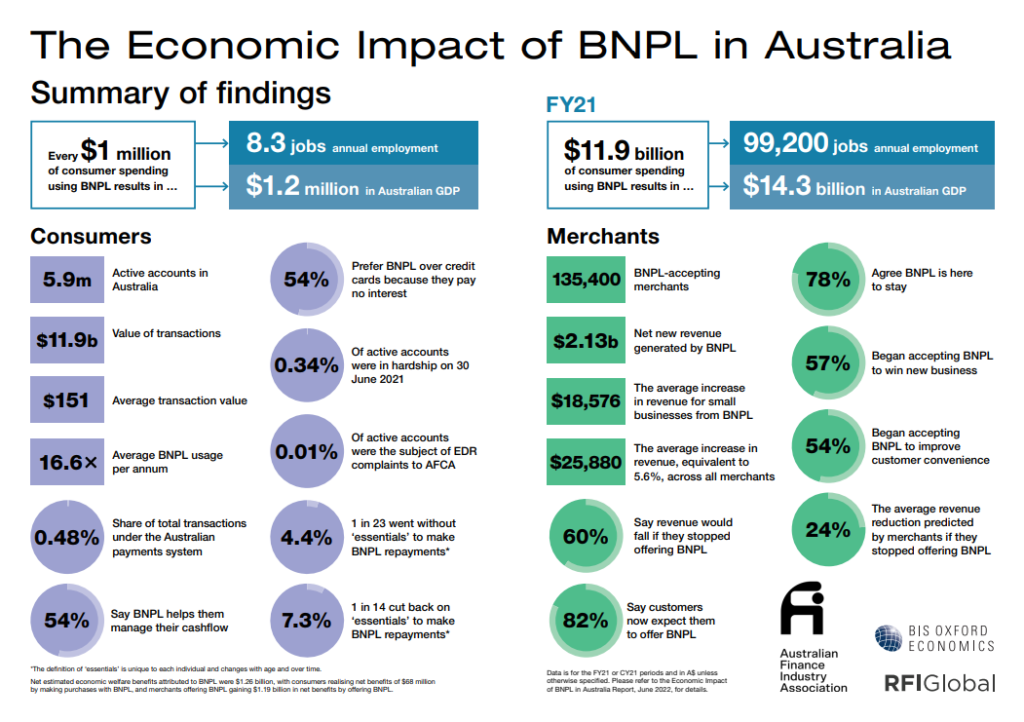

Relying on economic contribution and welfare economics approaches, we find that for Financial Year (FY) 2021, the BNPL industry helped create or retain some 99,200 jobs throughout Australia and contributed $14.3 billion in Gross Domestic Product (GDP) to the Australian economy.

Furthermore, we measure the combined consumer and merchant surplus benefits, or ‘net social surplus’, revealing merchants and consumers have continued to adopt BNPL because it provides advantages to other payment alternatives such as interest and fee savings, and growth in revenue and associated profits for merchants.

About the team

Our Economic Consulting team are world leaders in quantitative economic analysis, working with clients around the globe and across sectors to build models, forecast markets and evaluate interventions using state-of-the art techniques. Lead consultants on this project included:

Andrew Tessler

Head of Economic Impact Consulting, Australasia, OE Australia

Raúl Arias

Senior Economist, OE Australia

You might be interested in

Navigating Australia’s Labour Market

Explore July's labour market update: unemployment dips to 4.2%, showing stability despite economic challenges. Learn how these trends may impact the future.

Find Out More

Trade tracker – Tariff impacts continue to build

US tariff rates are climbing to levels not seen since the 1930s, with world trade expected to decline and inflation set to rise. What could this mean for global markets and economic growth?

Find Out More

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

Airbnb’s Economic Contribution to APAC in 2024: GDP, Jobs, and Regional Impact

Airbnb's platform connects hosts across Asia Pacific (APAC) with travellers from around the world. Oxford Economics was commissioned by Airbnb to quantify its economic footprint in 10 APAC markets in 2024.

Find Out More