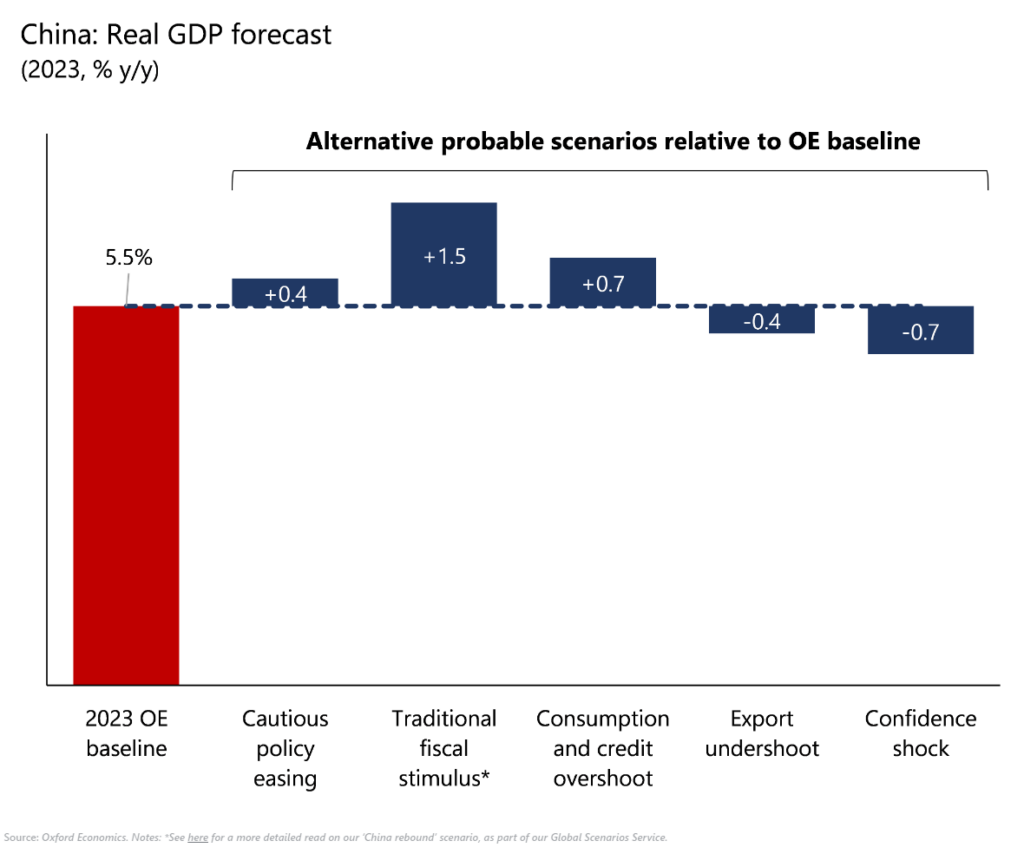

Exploring the plausible ‘What Ifs’ to our 2023 China GDP forecast

On the back of China’s recent consumption outperformance, we now expect the economy to grow by at least 5.5% in 2023. Market forecasts vary considerably, reflecting differences in assumptions around policy risk, the health of and outlook for the property sector, and the size and longevity of the reopening consumption boost.

What you will learn:

- As a thought experiment, we analysed five probable alternative scenarios using our Global Economic Model to gauge both the upside and downside risks to our 2023 outlook for China, and find a variance of around -0.7ppts to 1.5ppt to our 5.5% baseline growth forecast.

- Our analyses also demonstrate the clear limitations of policy easing, which in our downside scenarios prove insufficient to fully offset growth headwinds.

- In our base case and notwithstanding the eventual fading of a post-Covid consumption boost, growth in 2023 should comfortably exceed the official growth target. The unusual combination of a strong organic growth and still-significant economic headwinds (particularly towards H2) means that China’s monetary and fiscal policy stance could stay on hold for longer.

Tags:

Related posts

Post

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

Post

Roadblocks to China’s chip self-sufficiency dream

China is unlikely to achieve full chip self-sufficiency any time soon because of high technological hurdles in producing advanced manufacturing equipment and materials. The self-sufficiency target now stretches well beyond actual fabrication to include the entire chip supply chain as China struggles to acquire necessary input and machinery into the production process.

Find Out More

Post

Five lessons for businesses navigating tariffs and trade turmoil

In a rapidly evolving global trade environment, businesses must stay ahead of changing tariffs and regulatory demands. Our latest blog offers practical guidance on navigating tariffs, understanding key trade strategies, and leveraging accurate HS code classifications to optimize your supply chain. Explore essential insights that will help your business manage trade uncertainty, ensure compliance, and unlock new growth opportunities.

Find Out More