Quick Take – US correction to continue

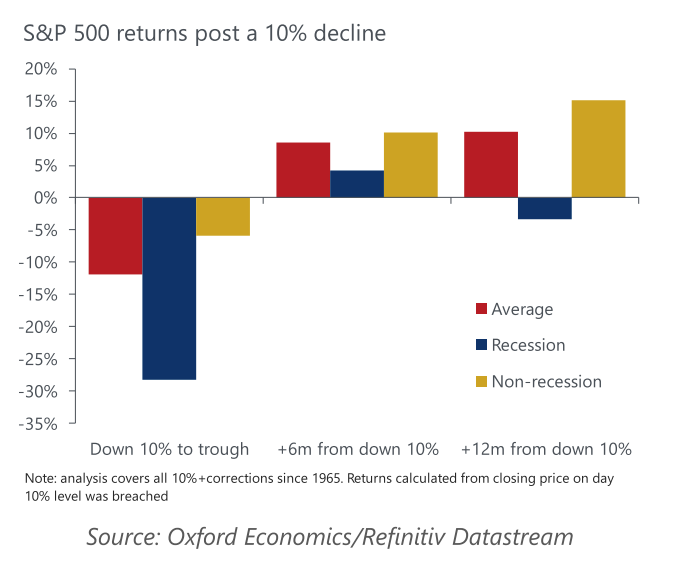

US equities dipped into correction territory last week and we see the risk of more downside in the near term, as valuations remain expensive relative to safe assets, investors have yet to capitulate, and earnings momentum is stalling.

Tags:

Related Posts

Post

Why bond yields are rising again and why it matters

The rise in bond yields reflects fiscal concerns, higher risk premia, shifting investor preferences, and idiosyncratic factors.

Find Out More

Post

Indirect climate risk in financial analysis

Climate and other sustainability challenges can affect the finance sector and have a material impact on returns to capital.

Find Out More

Post

Strategy Key Themes 2025: Opportunities amid heightened uncertainty

We think the environment of strong US demand coupled with still ample global liquidity, should be positive for US risk assets.

Find Out More