Wage rises in 2024 look set to be as high as this year in Japan

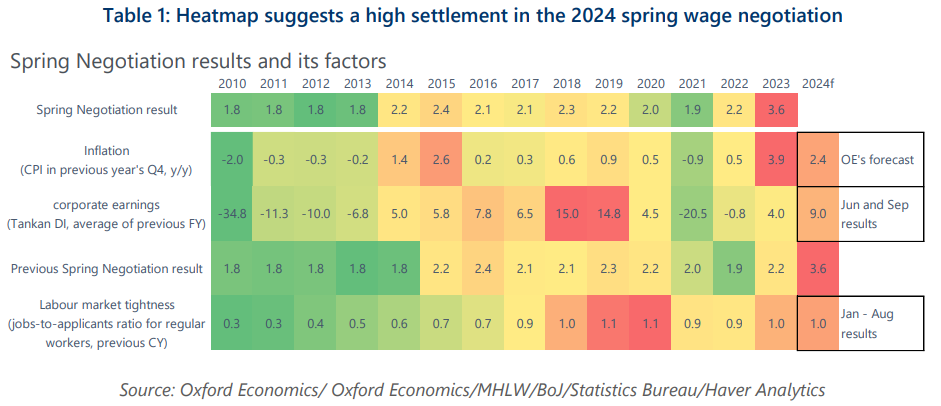

More market participants appear to have become confident that the wage-driven inflation is real, which will encourage the Bank of Japan to start normalizing its super-accommodative monetary policy in 2024. We revised up our projection for the spring wage settlement in 2024 to match the strength of the settlement in 2023. We believe that wage increase will continue after 2025, but achieving wage-led 2% inflation is still a long way off.

What you will learn:

- In addition to the need to compensate for higher-than-projected inflation in 2023, a severe labour shortage has pushed some firms with high profitability to raise wages more aggressively. Less profitable firms have no choice but to follow, spending their retained cash.

- Despite robust wage growth, we project that inflation will trend down throughout 2024 to a low 1.4% y/y in Q4 2024, from 3% in September 2023, as the pass-through of past import inflation wanes.

- We estimate growth in household income and consumption will not be robust enough to bring inflation back to 2%, although this is subject to high uncertainty. The magnitude and scope of wage increases will be constrained by Japan’s demographics and stagnant productivity growth.

- Based on the inflation outlook, we expect the BoJ to eliminate the negative interest rate in April 2024 after confirming the robust wage settlement, arguing that the economy is on track to achieve the 2% target in the coming years. Despite speculation about further rate hikes, however, we think the BoJ will maintain the short-term rate at an effective zero level thereafter.

Tags:

Related posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More