Surprisingly strong wage data ends NIRP and YCC in Japan

The Bank of Japan (BoJ) decided to end its negative interest rates policy and set the target band for the overnight market rate at 0%-0.1% at Tuesday’s meeting, earlier than our call for April. The first tally of the Spring Wage Negotiation, mainly for leading firms, was surprisingly strong, making the Bank confident about the wage-driven path to its 2% inflation target in coming years.

What you will learn:

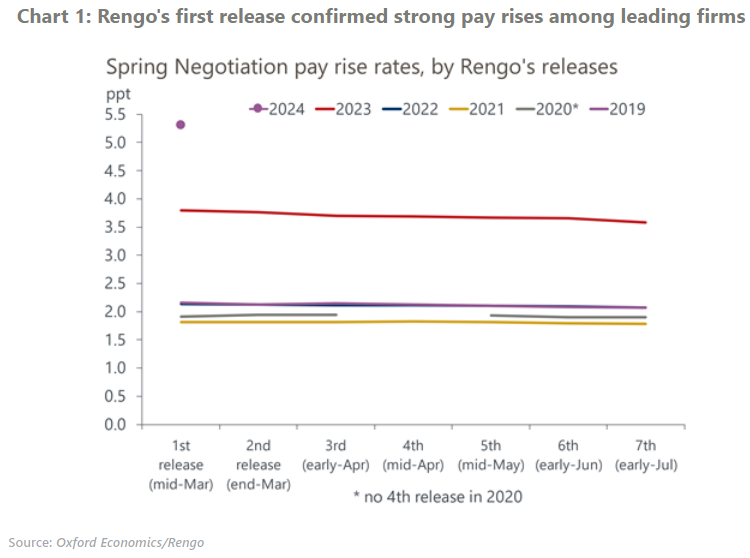

- In the first tally, the headline pay rise rate was 5.3%, much higher than the 3.8% in 2023 and market expectations. As the wage settlement for smaller firms become available, the pay rise rate will likely decline, converging to 4.5% which is the pay rise rate for small firms in the first tally.

- In order to guide market expectation for next policy moves, the policy statement said that “given the current outlook for economic activities and prices, the Bank anticipates accommodative financial condition will be maintained for the time being.” We anticipate the BoJ will maintain an effective zero-interest rate policy at least for another year.

- The BoJ also dismantled the yield curve control framework, which had increasingly become a formality after a decision in October 2023 to make it more flexible. In order to avoid disruptions in long-term yields, the bank commits to keep purchasing Japanese government bonds (JGB) close to its current pace for now, and promises to intensely increase them upon sharp yield rises.

- While committing to continue a quantitative easing (QE) policy through JGB purchases, the BoJ decided to formally end the purchase of risky assets such as ETFs and REITs which have not taken place for several months. We believe that the BoJ will come up with a comprehensive exit strategy from QE policy later this year after its ongoing policy review.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More