Weak world trade still a drag on global growth

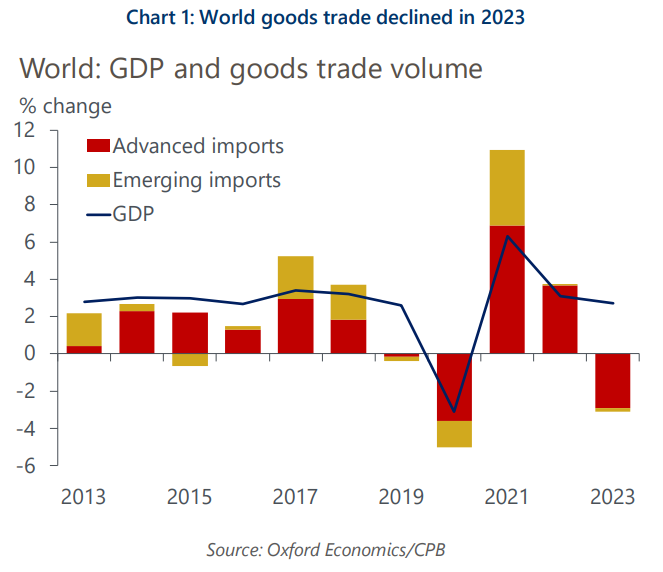

World goods trade declined in 2023, reversing the trend of 2022. This development points to the resumption of the decade-long pattern of slow global trade growth relative to GDP. Recent trade trends imply downside growth risks for 2024 and the longer-term outlook still looks to be one characterised by ‘slowbalisation’, especially with protectionism a rising issue.

What you will learn:

- Weakness in goods trade in 2023 was centred in advanced economies, especially Europe and Japan. Our survey-based indicator suggests global goods trade growth will remain stagnant into mid-2024, presenting a downside risk to our baseline trade forecasts.

- Muted external demand growth is one of the factors behind China once again starting to export disinflation to the world via lower export prices. The impact is not yet very large, but it could fuel protectionist pressures.

- Trade restrictions, in part linked to geopolitics, are a growing risk to long-term trade growth. The stock of restrictions has risen notably since 2016-2017 and there is a major new issue in the shape of distortionary industrial policies.

- The main area of fragmentation in the world trade system remains the US-China trade relationship. There are some signs this is spreading, however, such as the striking collapse of FDI into China in 2023, which implies lower trade in the future.

Tags:

Related Posts

Post

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

Post

The Future of Trade: Tariffs, Taxes, and Economic Trends

Amid ongoing global trade uncertainty, business leaders are struggling to plan ahead as new tariffs continue to reshape the market. Even so-called “locked-in” tariffs are proving to be temporary, adding to the unpredictability. Firms are cautious, waiting for clarity before committing to major investments. As global trade volumes decline, the importance of understanding every relevant trade tariff and accurately applying the correct HS code to imported goods becomes even more critical for managing costs and compliance.

Find Out More

Post

Fresh tariffs redraw trade map

Trump’s latest tariffs favour Australia and Singapore with unchanged 10% rates, while Brazil faces a sharp 50% hike. India, Vietnam, and Bangladesh continue to face some of the world’s highest effective tariffs despite recent declines.

Find Out More