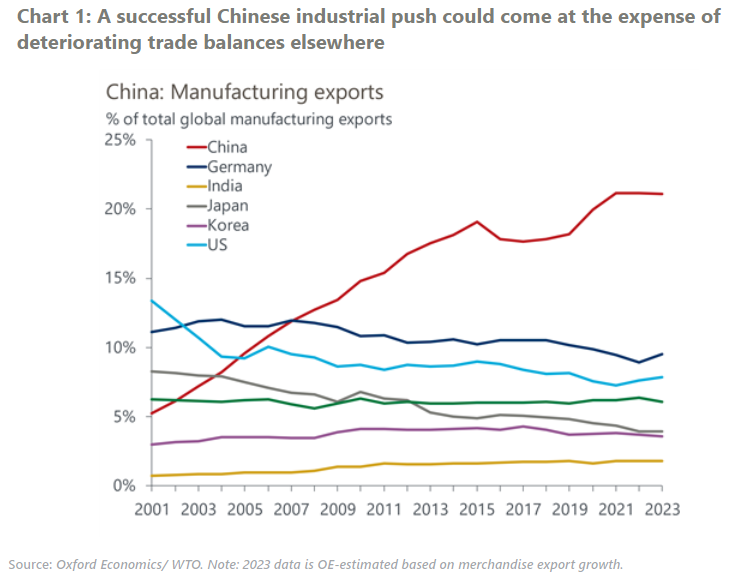

Beijing’s new industrialisation gamble – will it pay off?

Beijing’s reinvigorated support for manufacturing is quite the economic gamble. With property still in the doldrums and the post-Covid services recovery having largely run its course, the rationale is that manufacturing could minimise the risk of a broader activity slowdown.

What you will learn:

- But as demand remains tentative onshore, the natural and consequent reliance on an export-led growth strategy could worsen trade balances elsewhere, triggering more severe protectionism in retaliation. Already, momentum on that front is building across the US, EU and parts of emerging markets.

- This time around, state-favoured industries, including science, high-tech, and green sectors, have been the main beneficiaries of local lending activity, successfully translating the increased funding into increased productive capacity. In some of these industries, such as renewables and batteries, overcapacity has become an increasing risk, adding to disinflationary pressures.

- Still, macro data suggests China’s manufacturers remain highly export competitive. They are chiefly competing with regional or advanced economy peers in key export markets, reflecting an impressive range of product and cost competitiveness across the supply chain, particularly in niche areas like electronics.

- The other key difference in the current industrial policy push is that there’s likely much less upside now than in previous cycles for foreign multinationals and exporters of inputs into China’s manufacturing.

Tags:

Related Services

Post

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

Post

Roadblocks to China’s chip self-sufficiency dream

China is unlikely to achieve full chip self-sufficiency any time soon because of high technological hurdles in producing advanced manufacturing equipment and materials. The self-sufficiency target now stretches well beyond actual fabrication to include the entire chip supply chain as China struggles to acquire necessary input and machinery into the production process.

Find Out More

Post

Five lessons for businesses navigating tariffs and trade turmoil

In a rapidly evolving global trade environment, businesses must stay ahead of changing tariffs and regulatory demands. Our latest blog offers practical guidance on navigating tariffs, understanding key trade strategies, and leveraging accurate HS code classifications to optimize your supply chain. Explore essential insights that will help your business manage trade uncertainty, ensure compliance, and unlock new growth opportunities.

Find Out More