Research Briefing

| Jun 12, 2024

Chartbook: In search of Europe’s next logistics star city

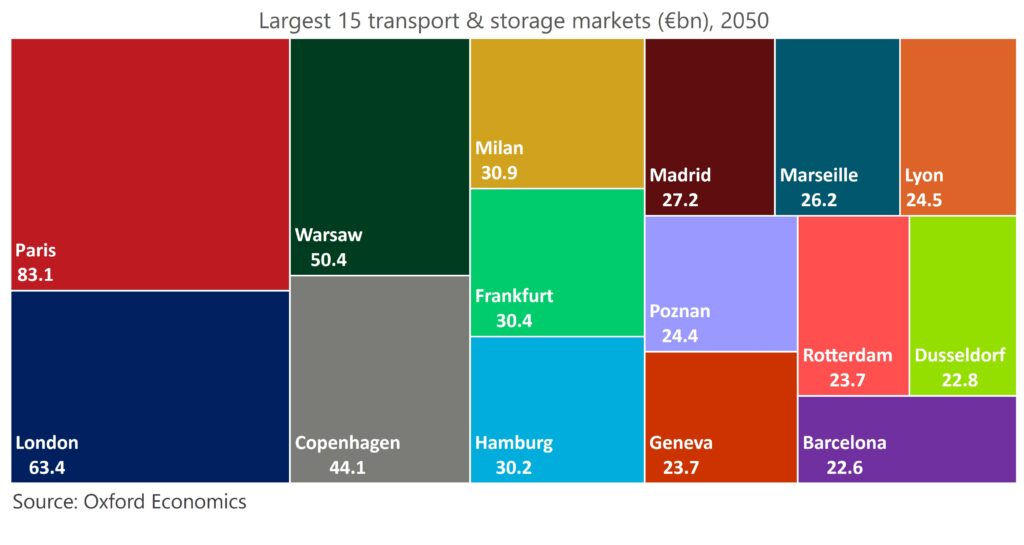

Europe’s 100 major cities account for almost 50% of transport & storage GVA in Europe, equating to €536 billion in 2023. By 2028, this figure is projected to rise by 22% to €656 billion, before surpassing €1 trillion in 2050. In our latest European Cities Logistics Chartbook, we share the following insights:

- Sector resilience: The transport & logistics sector displayed some resiliency during 2023. We estimate that growth in the sector slightly outperformed that of GDP over the past year.

- Leading logistics hubs: Paris and London are Europe’s largest centres for transport & storage, collectively generating €55.1 billion in GVA in 2023. As a share of total GDP, Copenhagen’s economy is the most reliant on the logistics sector.

- The biggest climber: Warsaw will be Europe’s biggest climber. It is currently Europe’s 17th largest logistics centre for GVA. But by 2050, the Polish capital will sit in 3rd place.

- Risks for Europe’s logistics centres: There are, however, several challenges facing Europe’s logistics hubs, including efficiency disruptions from recent onshoring trends, labour shortages in cities, and the need to decarbonise.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Office rents entering growth cycle in Australia

CBD office markets in Australia face high vacancy rates, but a supply shortage is expected to drive a strong rent recovery. Effective rents are forecast to rise sharply up to 108% in some cities by FY2035 as vacancy rates fall and incentives normalise.

Read more: Office rents entering growth cycle in Australia

Housing policy outlook clears after Federal Election in Australia

Saturday's Federal Election decisively delivered a second term for the Albanese government, clearing up the policy outlook.

Read more: Housing policy outlook clears after Federal Election in Australia

New indices offer insights into real estate sentiment

Our new suite of sentiment indices show global CRE sentiment has deteriorated significantly this year.

Read more: New indices offer insights into real estate sentiment

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights[autopilot_shortcode]