Japan’s BoJ will start reducing JGB purchases in August

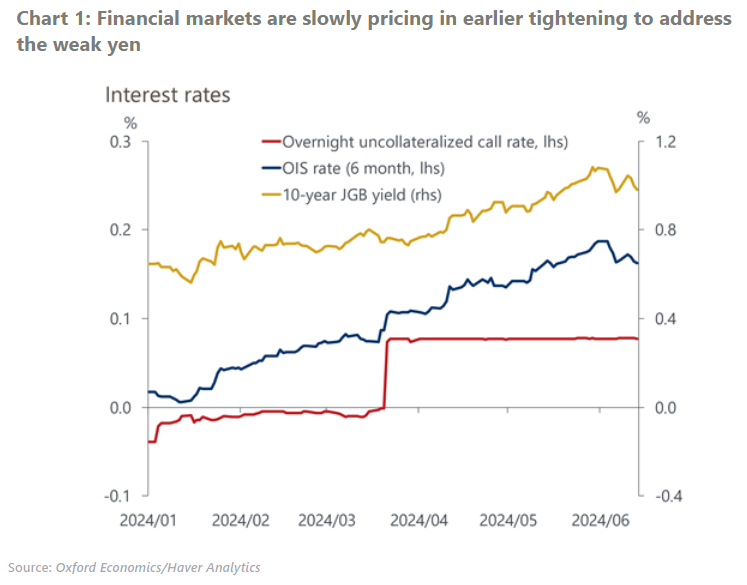

At Friday’s meeting, the Bank of Japan (BoJ) announced its decision to start reducing the volume of its JGB purchases by a substantial scale in August to ensure long-term rates are more market-oriented. At the next policy meeting on July 30th-31st, the bank will decide a detailed plan and schedule for the reduction covering the next two years after consulting with market participants.

What you will learn:

- As expected the BoJ decided to maintain its policy rate at 0%-0.1%. Wage growth looks set to remain robust based on the latest tally of the Spring Wage Negotiation, but household income and consumption are still weak and core-core CPI (excluding energy and fresh foods) eased further in April reflecting receding supply-side inflationary factors.

- Speculation over earlier tightening is rising in response to the weak yen. However, we believe the BoJ will wait until September to confirm that the strong wage settlement effectively raises real household incomes, and that consumption has gained momentum during the summer vacation.

- Despite recent hawkish statements by BoJ officials, we still think the yen weakness is unlikely to be a trigger for a rate hike. Most importantly, the BoJ’s rate hike will have only a limited impact on the currency which is dominated by the US monetary policy outlook.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More