Asia-Pacific: A modest 2024 for consumer spending in APAC cities

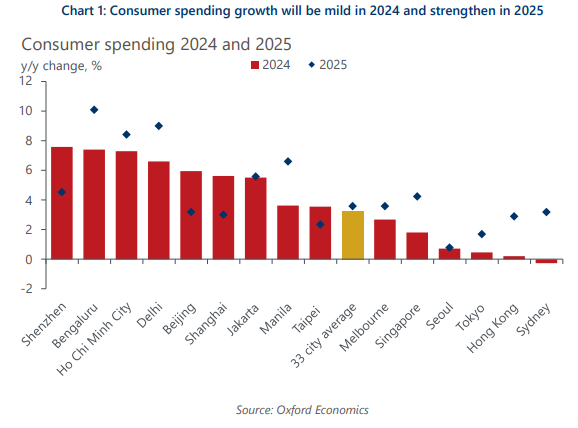

We forecast GDP growth in APAC cities will slow in 2024, falling to 3.3% on average. Persistent inflation and increased slack in labour markets will weigh on incomes, and so, on consumer spending growth. Consumers’ risk aversion, as reflected by low levels of consumer confidence, further point towards a soft year for APAC cities in terms of consumer spending. 2025 should mark a return to faster growth as the above-mentioned effects fade and tailwinds in the global economy strengthen.

What you will learn:

- Inflation has dropped more slowly than initially anticipated in several APAC cities, including Sydney and Seoul. We expect that continued price pressures in these cities will weigh on consumer’s spending power throughout 2024.

- Slower economic growth will likely translate into increased slack in the labour markets of several APAC cities. We forecast that unemployment will increase in places like Singapore and Sydney, leading to negative real income growth and slower growth in consumer spending.

- Low consumer confidence across APAC cities provides further support to our view of a modest year for consumer spending in the region’s cities. We think consumers will take a risk-off approach this year and generally stay away from big-ticket discretionary spending.

Tags:

Related Posts

Post

Airbnb’s Economic Contribution to APAC in 2024: GDP, Jobs, and Regional Impact

Airbnb's platform connects hosts across Asia Pacific (APAC) with travellers from around the world. Oxford Economics was commissioned by Airbnb to quantify its economic footprint in 10 APAC markets in 2024.

Find Out More

Post

Tariffs and tensions are reshaping city economies

Tariff policies, rising geopolitical tensions and unprecedented uncertainty are putting pressure on cities and regions across the world.

Find Out More

Post

What do the tariff letters mean for APAC and the China+1 strategy?

A tiered-tariff system effectively blurs the distinctions between goods made in China and those rerouted via regional supply chains, weakening the advantage of China+1 manufacturing.

Find Out More