Commodity Price Forecast: Energy price forecasts revised higher

What you will learn:

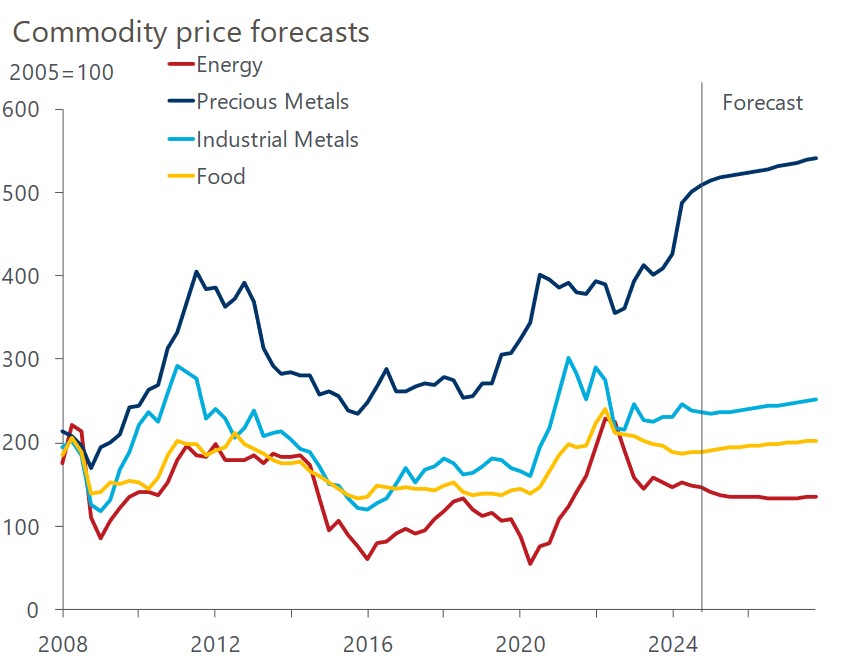

- Oil: Oil markets rebounded last month after a reassurance from OPEC+ that supply discipline would be maintained. Our view remains that the voluntary cuts will remain in place until Q1 2025, given market weakness, robust non-OPEC supply and perpetual bearish price action this year.

- Natural gas: We upgraded our natural gas price forecasts in the US and Europe due to greater demand from air conditioning over the summer months. However, our price forecast upgrade for Europe is more bearish than current market expectations as gas in storage will reach capacity by September with evidence of a structural decline in gas demand.

- Gold: We continue to see bullish fundamentals ahead and expect gold prices to trade above US$2,500/oz by mid-2025, with stabilising core yields that will soon add to the upward pressure.

To learn more about our price forecasts for base metals, precious metals, battery raw materials and soft commodities, please submit the form to download the full report.

Tags:

Related Resources

Post

Understanding the forces that drive global cotton prices

Forecasting the cotton market goes beyond understanding traditional agricultural metrics and into issues such as trade, energy and global economic trends.

Find Out More

Post

Cotton prices weighed down by loose market fundamentals

Cotton prices are forecast to remain weak in 2024 due to strong global supply and sluggish demand, weighed down by US trade tariffs, weak consumer spending, and rising competition from synthetics.

Find Out More

Post

What does the critical minerals boom mean for Africa? | Greenomics podcast

As demand grows for critical minerals like cobalt, copper, and lithium, African nations are navigating opportunities and risks—from boosting local employment to managing geopolitical tensions and environmental concerns.

Find Out More