Japan’s BoJ preview: What to expect for a QE exit plan

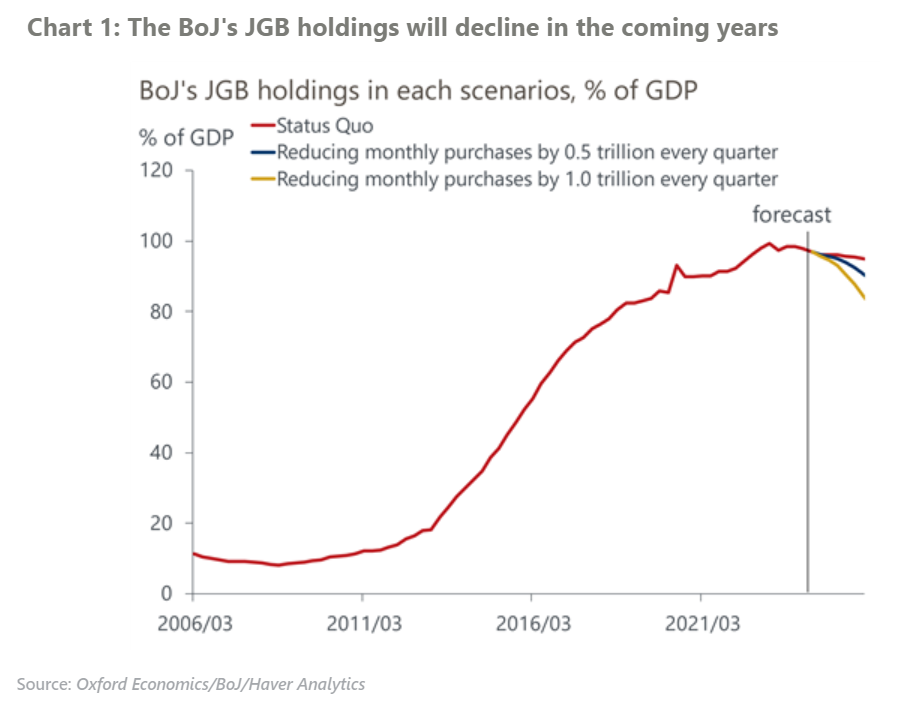

At the July policy meeting, the Bank of Japan (BoJ) will reveal its plan for reducing JGB purchases over the next one to two years. We project that the BoJ will reduce monthly JGB purchases by ¥0.5trn every quarter, from the current ¥6trn, to impress a “sizeable reduction” on the market, while avoiding a sharp rise in yields by stressing flexibility and predictability.

What you will learn:

- In this case, by end-2025, the BoJ’s monthly purchases will decline to ¥3trn and JGB holdings will drop by 5%. The BoJ’s share in outstanding JGBs will drop to 44% from 48%. The impact on the 10-year yield through the change of the “stock effect” of the BoJ holdings will be less than 10bps.

- We believe the BoJ’s approach will be gradual, flexible, and predictable, and therefore the impact on long-term yields will be manageable. In addition to the projected limited impact from the change of the “stock effect”, domestic savings will limit the increase in yields, especially through JGB purchases by banks.

- We continue to believe that the BoJ will wait until September for the next rate hike, despite the weak yen and market speculation. Data will not be ready to confirm if the strong Spring Negotiation wage settlement effectively raises household incomes and consumption. The BoJ will also want to preserve a rate hike to manage market pressures amid prolonged US dollar strength.

Tags:

Related Posts

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Catalyzing Africa’s Sustainable Transition: Insights to Impact a Climate-Resilient Future

Sustainable finance is not merely a climate imperative but a development necessity. As climate risks intensify, Africa must urgently mobilise capital to advance its adaptation, mitigation, and development goals. Realising this ambition will require coordinated action across governments, financial institutions, international partners, multilateral agencies, and the private sector. With bold leadership, innovative tools, and supportive ecosystems, the continent can chart a path toward a more inclusive, resilient, and sustainable global economy.

Find Out More

Japan’s worsening fiscal outlook raises risk of higher term premium

We expect Japan's fiscal outlook to deteriorate due to weak economic growth and pressure on the government to implement fiscal stimulus. We don't think deficit concerns drove the recent spike in ultra-long Japanese government bond (JGB) yields, but as domestic purchasers reduce their JGB holdings, long-term yields could become more sensitive to fiscal developments in the coming quarters, raising the risk of a higher term premium.

Find Out More