Six lessons from the US-China trade war as the next phase looms

With further tariff increases on US imports from China effective from August 1st, 2024 and potentially more to come after November’s US presidential election, we take this opportunity to examine the implications and outlook of the US-China trade war.

What you will learn:

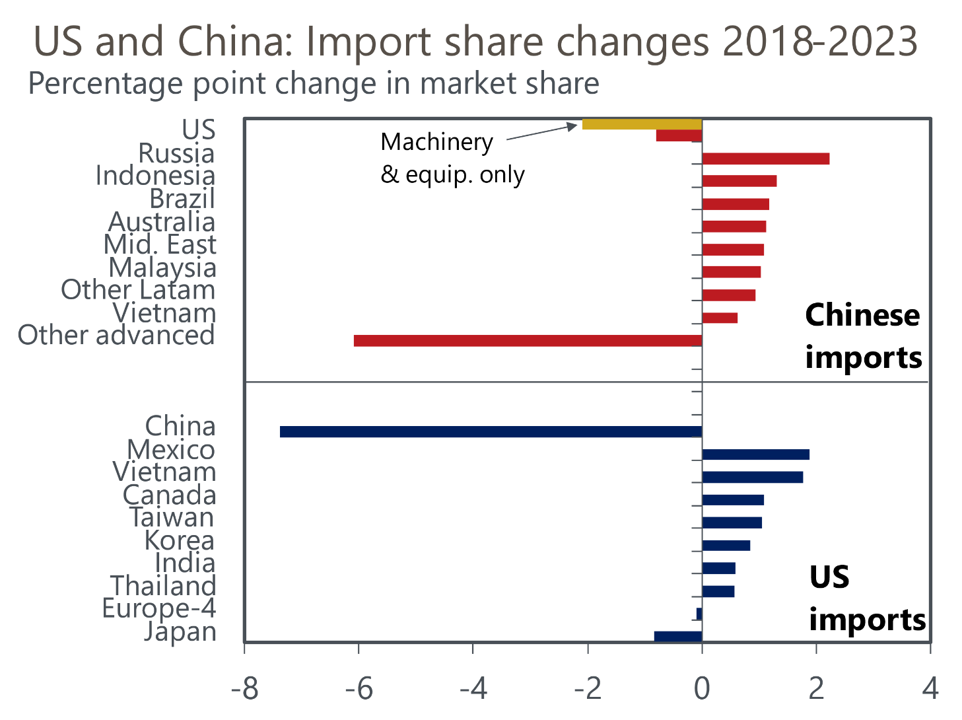

- US tariffs have cut imports from China by 35%-40% relative to plausible counterfactual paths, and the impact has risen over time. We estimate a 1ppt rise in US tariffs cuts imports from China by 2.5% in the long term, meaning the high tariffs now being discussed in the US would be prohibitive.

- Suppliers in NAFTA and other Asian economies have stepped into the gaps left by China. This may encourage additional US protectionism versus China. Evidence of some Chinese goods being re-routed into the US to evade tariffs, meanwhile, may see third countries being targeted as well.

- US tariffs have not shrunk its overall trade deficit even if the deficit with China has shrunk. Trade conflict has cut US GDP by an estimated 0.2%-0.4% and raised prices by 0.1%-0.3%.

*Europe 4: Germany, France, UK, and Italy

Tags:

Related Resources

Post

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

Post

The Future of Trade: Tariffs, Taxes, and Economic Trends

Amid ongoing global trade uncertainty, business leaders are struggling to plan ahead as new tariffs continue to reshape the market. Even so-called “locked-in” tariffs are proving to be temporary, adding to the unpredictability. Firms are cautious, waiting for clarity before committing to major investments. As global trade volumes decline, the importance of understanding every relevant trade tariff and accurately applying the correct HS code to imported goods becomes even more critical for managing costs and compliance.

Find Out More

Post

Fresh tariffs redraw trade map

Trump’s latest tariffs favour Australia and Singapore with unchanged 10% rates, while Brazil faces a sharp 50% hike. India, Vietnam, and Bangladesh continue to face some of the world’s highest effective tariffs despite recent declines.

Find Out More