Japan’s BoJ is now likely to front-load policy normalisation

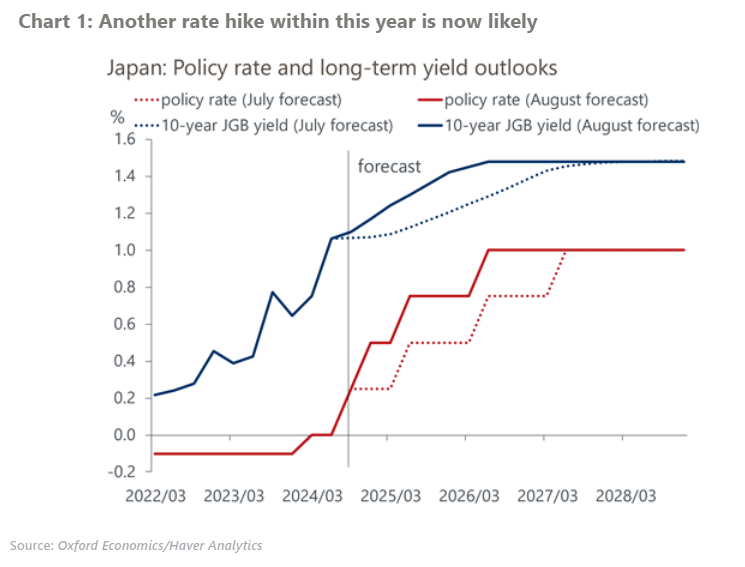

We now expect the Bank of Japan will implement an additional rate hike this year, possibly in October, given the hawkish forward guidance at the July meeting. We previously projected the central bank would wait until next spring to hike again. Thereafter, we expect the BoJ to become more cautious and raise rates only once per year in 2025 and 2026 to reach a terminal rate of 1%.

What you will learn:

- The BoJ’s July policy statement said that the central bank will continue to normalise its policy rate as long as the economy stays on track with their projections. The BoJ emphasised that real interest rates are still significantly low and the policy rate will not likely reach the estimated range of a neutral rate anytime soon.

- We project the front-loaded rate hikes will have a manageable impact and not derail the economy from the wage-driven inflation process. A high proportion of households with net savings due to the aging society, together with the correction of yen weakness, will limit the damage to consumption. Decades of deleveraging has lowered the sensitivity of capex to a rate rise.

- The policy outlook faces high uncertainty. Financial market instability in early August invited criticism that the BoJ was too hasty to hike. Although a large chunk of yen carry trades appears to have been unwound for now, the BoJ may hesitate to hike rates if market instability relapses.

- Politics could become less supportive of rate hikes depending on who will succeed Prime Minister Fumio Kishida in September. While the unpopular yen weakness has receded for now, politicians may worry more about possible stock price correction and the rising damage to vulnerable but politically important agents, including hand-to-mouth households and micro enterprises.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More