Asia Pacific: Summertime blues foreshadow the slowdown

Four themes have dictated Asia’s macroeconomic outlook over the summer and are likely to continue to exert an influence over the rest of the year and into 2025, in our view.

What you will learn:

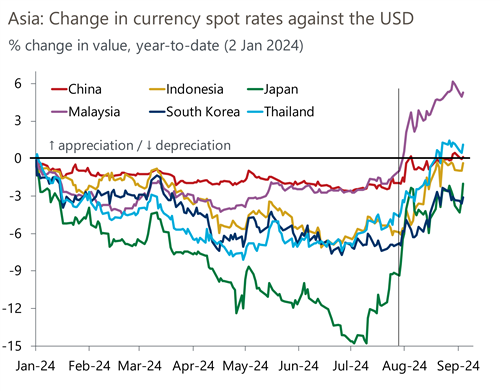

- The first is the financial market volatility we saw in early August that has resurfaced this week. Among other concerns, worries are building that growth in the US could slow by more than what financial markets had discounted, and that the Federal Reserve may have waited too long to cut rates and slipped ‘behind the curve’. We look at how that could affect Asia.

- Second, we have now received Q2 growth data from across Asia. While not apparent from year-on-year numbers, a closer look indicates that the growth slowdown may already be upon us. What’s more, it looks unlikely that aside from the current boost from AI, Asia has an engine of growth to rely on.

- Third, given a cut in the Fed Funds rate is imminent and that Asian central banks’ usual reaction is to follow the Fed, we ask will this time prove the exception? We think three central banks – India, Malaysia, and Thailand – are unlikely to be moved. We examine the reasons for the exceptionalism and the likely monetary stance in those countries.

- Fourth, in China the tussle between a structural slowdown and cyclical policy support seems to be going the way of the former. Growth in Q2 was worse than expected and a turnaround appears unlikely. Exports are doing well, but that strength is unlikely to endure.

Tags:

Related Posts

Post

House prices continue to slide for China’s cities

Research Briefing Asia Pacific: Summertime blues foreshadow the slowdown While the property market downturn has been universal, the scale and depth has been varied for different cities and regions.

Find Out More

Post

Airbnb’s Economic Contribution to APAC in 2024: GDP, Jobs, and Regional Impact

Airbnb's platform connects hosts across Asia Pacific (APAC) with travellers from around the world. Oxford Economics was commissioned by Airbnb to quantify its economic footprint in 10 APAC markets in 2024.

Find Out More

Post

Roadblocks to China’s chip self-sufficiency dream

China is unlikely to achieve full chip self-sufficiency any time soon because of high technological hurdles in producing advanced manufacturing equipment and materials. The self-sufficiency target now stretches well beyond actual fabrication to include the entire chip supply chain as China struggles to acquire necessary input and machinery into the production process.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More