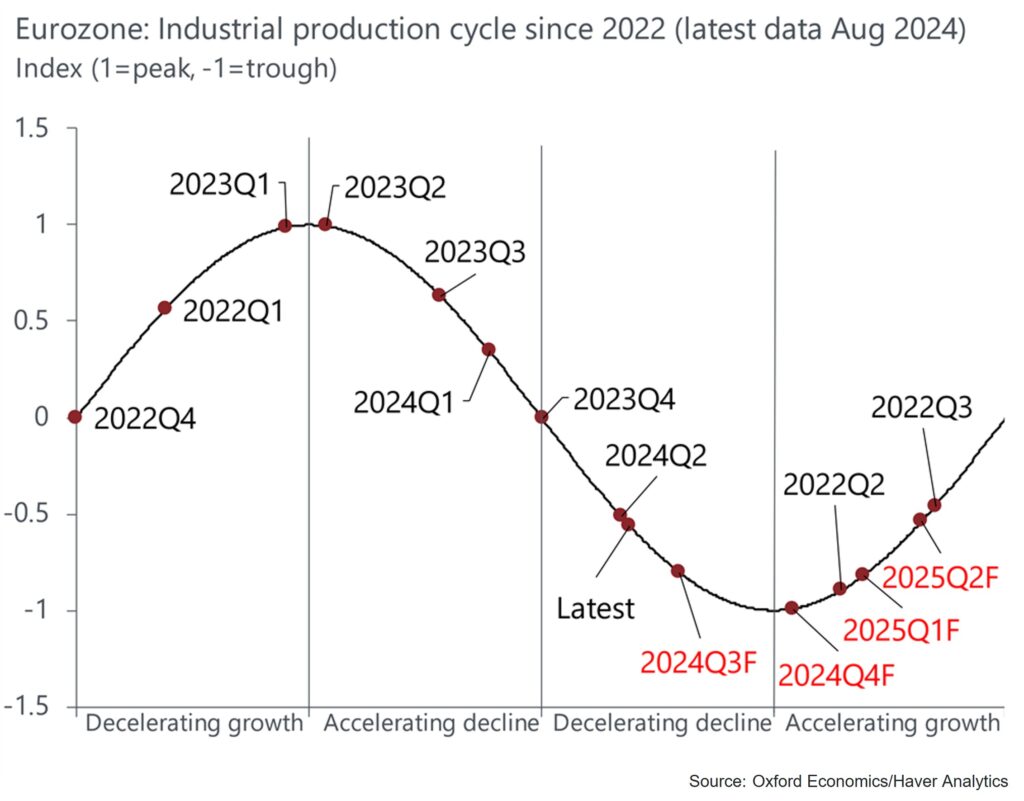

European industry will bottom out and recover…eventually

European industry is still in the midst of an almost two-year recession, but we believe that the end is increasingly in sight. Our proprietary business cycle indicator is picking up signs that the pace of decline is moderating which, combined with our forecasts for industrial production, suggests a business cycle trough is approaching.

What you will learn:

- Our latest estimate shows output bottoming out towards the end of this year or beginning of next, setting the stage for an industrial expansion across 2025.

- Falling gas and electricity prices have already provided a boost to energy-intensive sectors, which are at the forefront of growth currently. However, the smaller reach of these sectors means that the broader industrial recovery will have to wait for the effect of interest rate increases to filter through to the real economy, for the inventory cycle to turn, and for consumers’ appetite for goods spending to fully return.

- The risks to our current forecast are firmly on the downside. Weakness in industry has been correlated strongly with weakness in the broader economy, and the eurozone economy has consistently defied expectations it would begin bouncing back.

Tags:

Related Resources

Post

Roadblocks to China’s chip self-sufficiency dream

China is unlikely to achieve full chip self-sufficiency any time soon because of high technological hurdles in producing advanced manufacturing equipment and materials. The self-sufficiency target now stretches well beyond actual fabrication to include the entire chip supply chain as China struggles to acquire necessary input and machinery into the production process.

Find Out More

Post

European defence spending surge: which sectors will benefit?

Our modelling suggests the main beneficiaries of the spending will be a highly concentrated subset of capital-intensive subsectors, mainly in transport and electronics.

Find Out More

Post

Industrial recession still expected due to global tariff chaos

Tariffs spark uncertainty in the global industrial sector, raising recession risks. What’s next for businesses? Discover insights from Oxford Economics.

Find Out More