Japan’s shock election defeat for the LDP, but policy shift unlikely

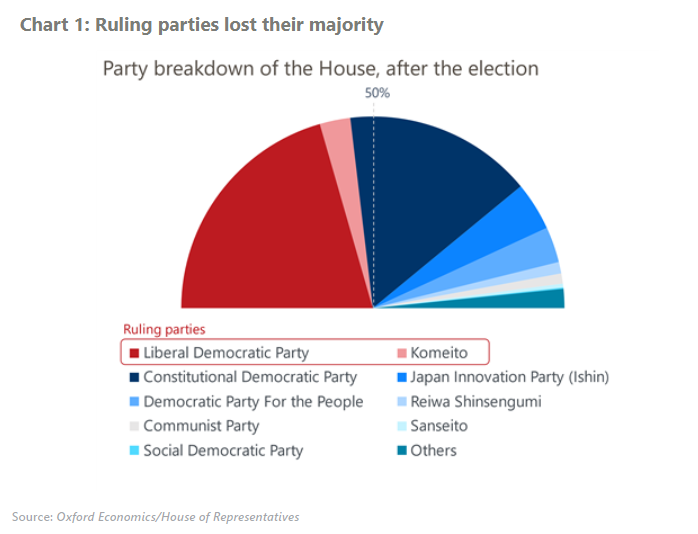

The ruling Liberal Democratic party and its partner Komeito lost their majority in Japan’s lower house elections on Sunday, which means the two parties will likely be forced to manage the government as a minority ruling coalition.

What you will learn:

- Despite the febrile political situation, we don’t intend to change our forecasts at this point because the LDP’s wage-driven growth strategy has broad support among opposition parties.

- The Prime Minister Shigeru Ishiba has committed to maintain the economic policy framework of the previous administration. Under greater political pressure, we expect he will focus on pro-growth and market-friendly policies that support vulnerable households and regional economies. Opposition parties may call for greater fiscal expansion to support vulnerable households. However, we think Ishiba will likely refrain from discussing painful revenue measures.

- On monetary policy, although we still assume the Bank of Japan will hike rates in December, the government could become more cautious about the pace of normalization.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More