China strategising for a second Trump term

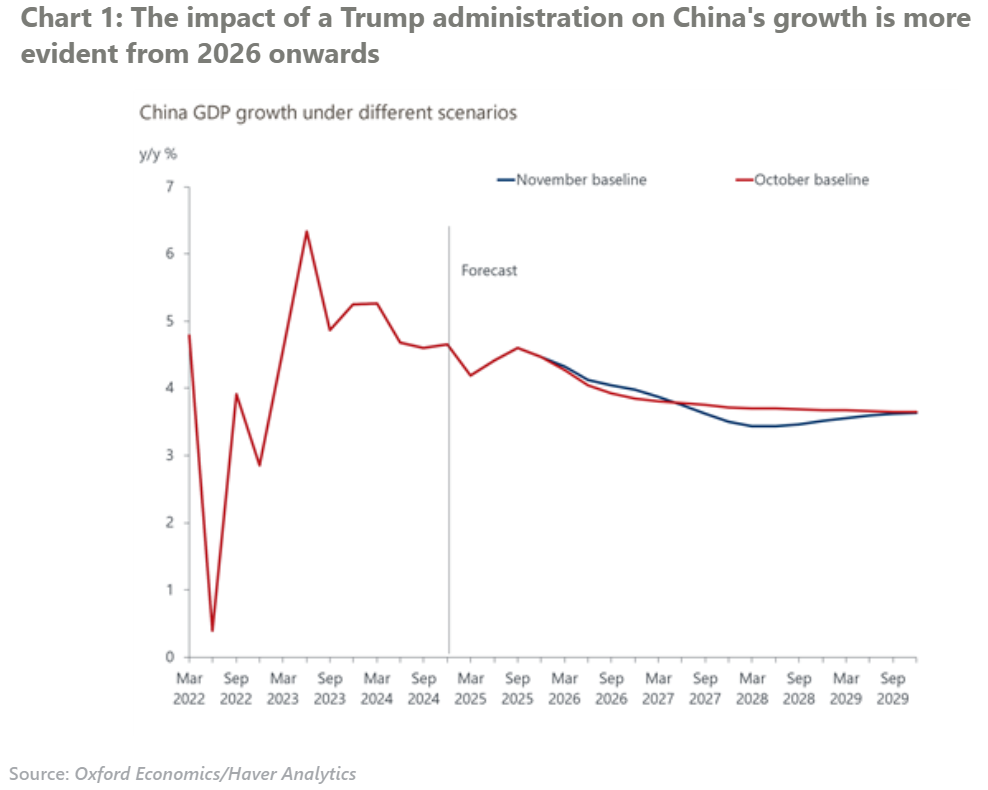

US tariffs under a Trump presidency and a Republican-led Congress are a major concern for China. However, we expect additional US tariffs wouldn’t be implemented until as late as 2026 and the effects could be mitigated early on by expansionary fiscal policy in the US.

What you will learn:

- Our modelling suggests that US tariffs could reduce China’s GDP by a cumulative 0.4ppts over 2027-2029, which would be manageable. However, the magnitude and the timing of tariff increases will affect the ultimate outcome and we believe the risks are skewed to the upside.

- China has developed a versatile set of tools beyond simple tit-for-tat trade retaliation to respond since 2016-2020, when the previous Trump administration imposed the first set of tariff hikes. China could weaken its currency and increase export tax rebates as defensive moves. Restricting exports of essential materials such as rare earth metals, and imposing tariffs on strategic US import sectors are also plausible measures.

- Though not an imminent threat, external uncertainties could require a more forceful domestic response, especially considering the severe downward pressure on China’s economy. In the longer term, China’s industrial policy may become more domestically focused, with a stronger emphasis on industrial competitiveness.

Tags:

Related Services

Post

Trade tracker – Tariff impacts continue to build

US tariff rates are climbing to levels not seen since the 1930s, with world trade expected to decline and inflation set to rise. What could this mean for global markets and economic growth?

Find Out More

Post

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

Post

US tariffs and the uneven impact across cities in Europe and Asia

The latest US tariffs are reshaping global trade patterns, hitting some cities harder than others. From Germany’s auto hubs to China’s electronics exporters, which regions will weather the storm and which will struggle?

Find Out More

Post

Five lessons for businesses navigating tariffs and trade turmoil

In a rapidly evolving global trade environment, businesses must stay ahead of changing tariffs and regulatory demands. Our latest blog offers practical guidance on navigating tariffs, understanding key trade strategies, and leveraging accurate HS code classifications to optimize your supply chain. Explore essential insights that will help your business manage trade uncertainty, ensure compliance, and unlock new growth opportunities.

Find Out More