Trump’s tariffs will likely exacerbate the slowbalisation globally

Our latest economic forecasts assume Trump will impose a 30% across-the-board tariff on Chinese imports into the US, a 25% tariff on selected goods from Europe including steel, aluminium, and automobiles, and a 10% tariff on selected goods in Canada, Mexico, Japan, South Korea, and Vietnam. This would take the effective tariff rate on US goods imports to around 6% from 2%.

What you will learn:

- Donald Trump’s victory in the US elections heralds a potential upheaval in global trade. We don’t know exactly what tariffs Trump will enact, but his campaign rhetoric and his political appointments so far suggest he will implement significant changes to policy.

- From Trump’s first term, we’ve learnt that trade wars affect a broad range of goods, not just those facing tariffs. So, the hit to trade outside of China may extend beyond the selected goods on which we expect tariffs will be applied.

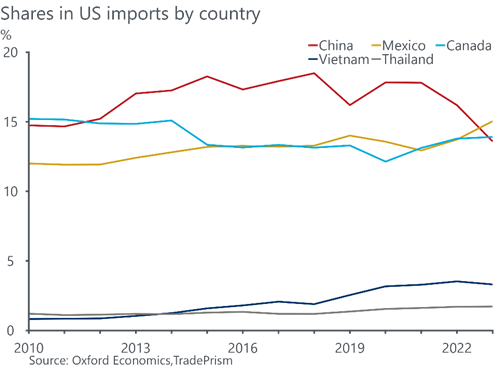

- New tariffs on China would intensify its decoupling from the US which has already been building over the past eight years. On top of this, the inclusion of Asia in the next phase of tariffs would limit the ability to reduce the hit from higher tariffs by rerouting trade. Consequently, we think Trump 2.0 will add to the slowbalisation that is already taking place.

- We expect Trump’s tariffs will reduce global trade values by more than 7% by 2030 compared to our pre-election forecasts. By contrast, we only anticipate a modest 1.8% hit to nominal GDP over the same period.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More