Japan’s BoJ outlook update – Rate hike is now more likely in January

We now believe that the Bank of Japan will wait until January to hike the policy rate. We previously assumed a 60% chance of a hike at the meeting on December 19, but recent media reports signal that more board members will likely prefer to wait to see more data to confirm the momentum of wage-driven inflation and US policy developments.

What you will learn:

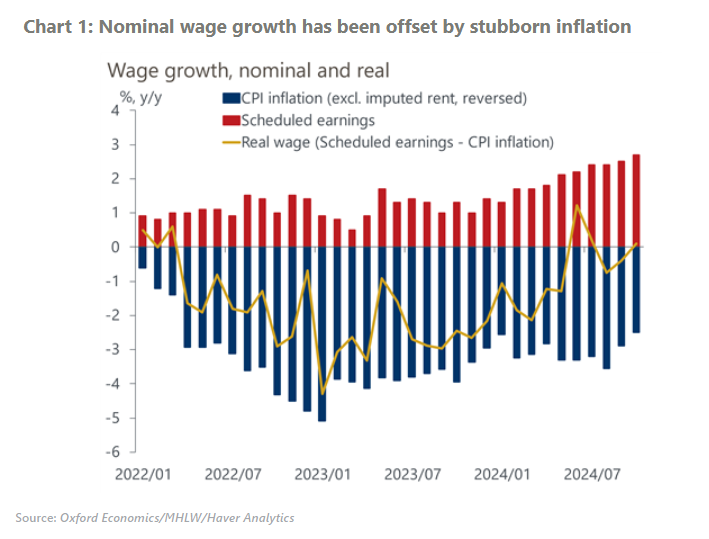

- Recent data show that the Japanese economy is on-track to achieve 2% inflation driven by wage rises, but there are also some weak spots. Nominal wages have risen at the rate consistent with target inflation in the medium-term, but high inflation has yet to generate any sustained increase in real wages. If lacklustre consumption fizzles out as a result, then inflation could fall back again.

- Yen weakening has become less of a threat, which will also allow the central bank to move more cautiously. We previously assumed the BoJ would move sooner than later to demonstrate its strong appetite for policy normalization to check the rising threat of further yen weakening triggered by Trump’s win in the US elections.

- Next month, we will slow the projected pace of rate hikes in our baseline after examining the outcome of the December meeting. After the expected hike in January, subsequent hikes will likely be in July 2025, instead of our previous projection of May, and the spring of 2026 before reaching a terminal rate of 1%. The pace could be affected by the yen’s developments.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More