Trump policies provide tailwinds for industries, with exceptions in Japan

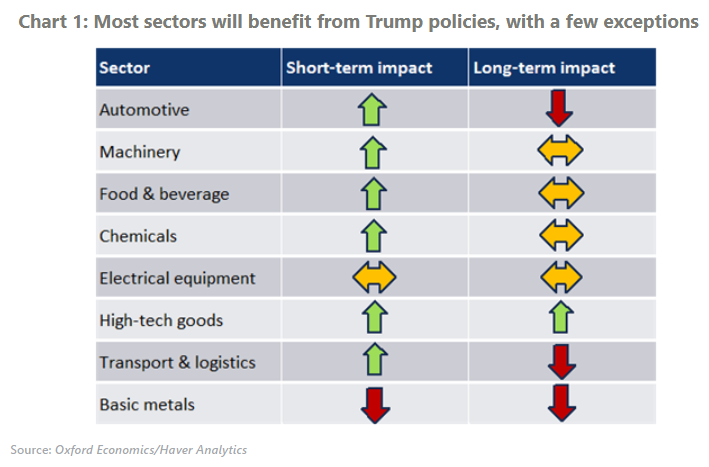

We expect the impact of Trump policies will be a net positive for Japan. The boost from higher import demand due to expansionary fiscal policies will likely overwhelm the adverse impact of targeted tariffs on Japan. The US is Japan’s biggest goods export destination, accounting for 20% of total. Most traded items such as machinery and automotives are set to benefit from higher investment demand and consumer spending.

What you will learn:

- The 30% blanket tariffs on China by the US will also prompt production shifts away from China. Although Japan will not be able to compete with its neighbouring emerging economies on cost in many industries, sectors such as machinery and electronics might reap some benefit.

- The machinery sector has a very high potential to benefit from President-elect Trump’s policies given that it is export- and capital-intensive, and Japan has a technological edge in the sector. Protectionism in the US could fuel further protectionist measures in other countries, prompting governments and firms to become more inward-looking and to prioritise localising production, which will also drive demand for machinery.

- In our latest baseline, we expect the automotive and basic metals sectors to be subject to 10% tariffs by the US. Given the commoditised nature of basic metals, Japanese exports to the US will likely decline. However, the US share of Japan’s base metal exports is only 6%, limiting the impact on production. In the case of automotive, it already faces 2.5% tariffs by the US, and consumers’ tastes and preferences for brands and vehicle type should partly work as a buffer.

- High-tech goods, including semiconductors, are also set to benefit as companies look to diversify their supply chains. While back-end processes for chip production like assembly, testing, and packaging are more likely to move to Asian emerging markets such as Vietnam and Malaysia, Japan could benefit from higher demand for front-end processes, where patterns are printed on the wafer. Japanese government’s effort to revive its domestic chip sector, represented by establishment of Rapidus and TSMC’s first Japan plant coming online in 2024, bodes well.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More