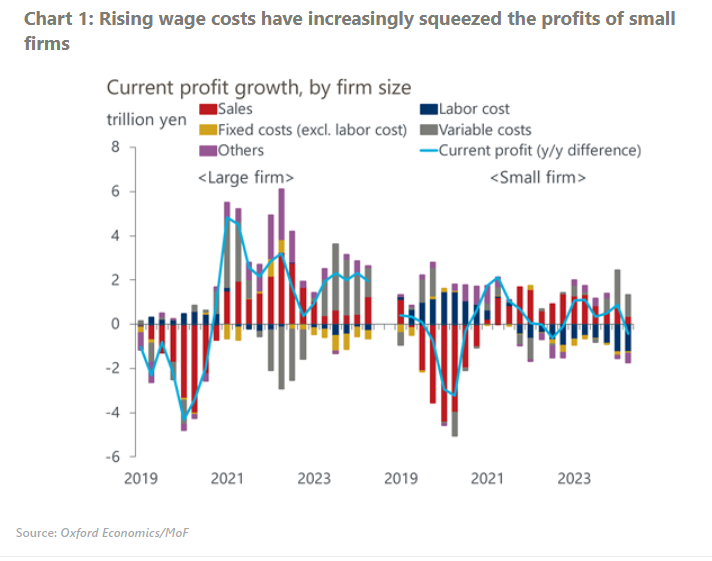

Japan’s small firms’ profitability will help determine further rate hikes

Rising wage costs have been increasingly squeezing the already low profitability of small firms in Japan, thereby raising concerns about the sustainability of the wage-driven inflation dynamics. The evolution of these dynamics will be key in determining how far the Bank of Japan can raise its policy rate in the coming years.

What you will learn:

- The profitability of small firms has remained almost flat despite their efforts to raise sales by passing on rising costs to prices. Lacklustre consumption has restrained their pricing power and their productivity growth has remained stagnant. Small firms have higher wage costs as a percentage of sales and low profitability makes them vulnerable to projected rate hikes.

- We project small firms will manage to keep pace with the wage increases set by leading large firms this year. However, given the wide variation in the profitability of small firms, more unprofitable firms will likely start to fall behind the overall wage growth trend. The BoJ will take time to examine wage rises in small firms before possibly hiking the policy rate in July.

- In the coming years, we project the wage gap between large firms and small firms will widen. Risks to the capacity of small firms to follow the overall pace of wage growth are tilted to the downside. Major risks to our outlook are disappointing growth in consumption and a persistent rise in import costs due to external shocks, including further yen weakening.

Tags:

Related Posts

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More