World Economic Prospects

Each month Oxford Economics’ team of 300 economists updates our baseline forecast for 200 countries using our Global Economic Model, the only fully integrated economic forecasting framework of its kind. Below is a summary of our analysis on the latest economic developments, and headline forecasts. To access the full report (and much more), request a free trial today.

Request a free trial

Economic consequences of tariffs are becoming evident

- We now expect world GDP to expand by 2.6% this year and 2.4% in 2026. We’ve raised our forecast for this year by 0.1ppt because activity has been boosted by firms trying to frontload orders ahead of tariff deadlines. But we expect quarterly GDP growth rates will slow in H2 2025 and have lowered our GDP growth forecast for next year by 0.1ppt.

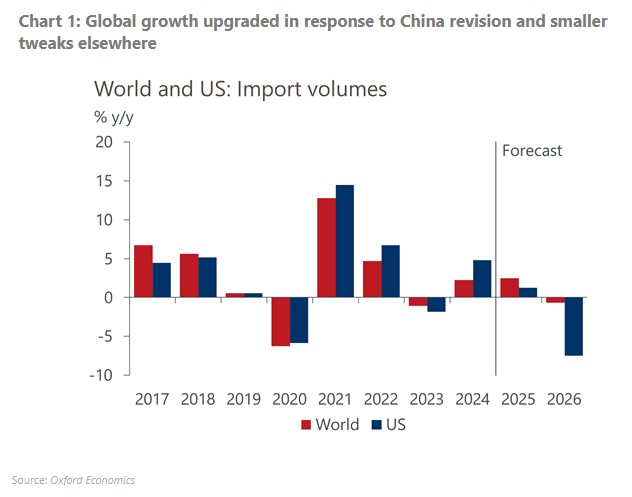

- Our estimate of the weighted average of announced US tariff rates has risen above 18% following a flurry of announcements and last-minute trade deals over the past month. If complied with in full, this would be the highest level since the mid-1930s. The impact on global trade will be mitigated by limited retaliation, but we expect trade to decline by 3% from Q2 2025-Q1 2026.

- Recent data suggest that the effects on the US economy of higher tariffs are becoming more marked. Labour market data for July was soft, with a low headline figure for payrolls and large downward revisions to previous months. Survey data has also been downbeat, in line with our forecasts for US growth of just 1.7% this year and 2% in 2026.

- There are signs that tariffs are pushing up prices of categories of goods in the US where import penetration is high. We continue to expect headline US inflation will rise above 3% y/y by year-end, from 2.5% in Q2. This will encourage the Federal Reserve to remain cautious, so we expect the next rate cut will occur in December with significant policy easing delayed to 2026.

- China’s exports to the US have been the hardest hit by tariffs so far, though China has expanded sales rapidly to other economies. We have revised down our forecast for Chinese growth in 2026 by 0.1ppt to 4%. In the Eurozone, we have slightly raised our forecast for this year but revised down our estimate of 2026 growth to 0.8% due to worsening external conditions and high uncertainty.

- Measures of trade policy uncertainty have dropped back from their peaks but generally remain elevated and we expect this to weigh on global investment. Financial markets, especially stocks, have proved fairly resilient to recent tariff news, but we expect them to become increasingly sensitive to any negative surprises in incoming growth and inflation data.

Request a Free Trial

Complete the form below and we will contact you to set up your free trial. Please note that trials are only available for qualified users.

We are committed to protecting your right to privacy and ensuring the privacy and security of your personal information. We will not share your personal information with other individuals or organisations without your permission.

Find out how Oxford Economics can help you

Talk to us