Japan’s supply-driven food inflation to persist longer than expected

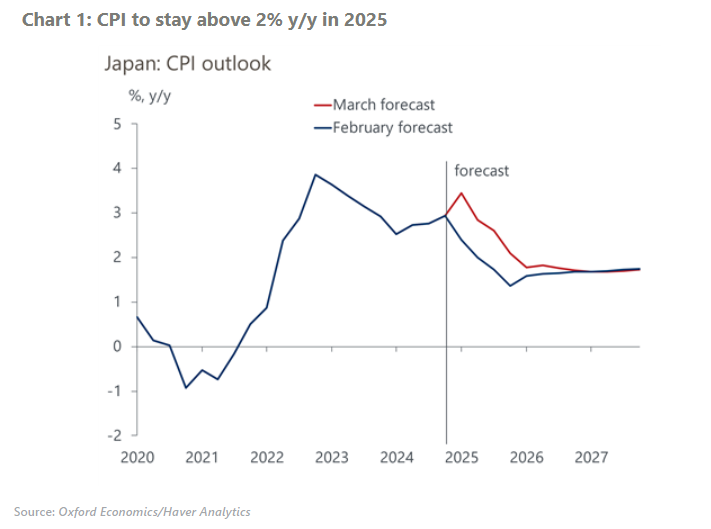

We have revised our CPI forecast upwards for this year and next, due to more persistent supply side-driven food inflation, led by soaring prices of rice. Despite the significant revision to the short-term inflation path, we don’t expect the Bank of Japan (BoJ) to react with a rate hike.

What you will learn:

- A combination of record summer heat in 2023, panic buying, and speculative trading has driven rice prices upwards. Despite a good harvest in 2024 and the government’s decision to sell its rice stockpiles, prices are still rising and we now expect them to decline more slowly than we previously anticipated.

- The prices of non-fresh foods other than rice have also registered modest but persistent inflation, of 3%-4%, reflecting the pass-through of rising input costs, including the lagged impact of yen weakening and a sharp rise in logistics costs.

- We have not changed our monetary policy forecast since the supply-driven food inflation, especially rising rice prices, will likely stabilise. That said, we will closely monitor how higher food inflation affects inflation expectations. We have nudged up our 10-year Japanese government bond (JGB) forecast to reflect a higher inflation risk premium.

Tags:

Related Posts

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More