Japan’s on course for July rate hike, but risk of June increases

The Bank of Japan (BoJ) kept its policy rate at 0.50% at Wednesday’s meeting, as expected. Despite a marginally higher increase in pay than last year at the first round of the spring wage negotiations, our baseline view is for the BoJ to hike its policy rate only gradually due to concerns about the capacity of small firms to raise wages and the lacklustre rate of consumption.

What you will learn:

- We still expect the next hike will take place at July’s policy meeting, but the BoJ might move in June if wage agreements at small firms exceed expectations. Moreover, risks to the global outlook posed by the shift in US policy and the potential for political uncertainty around the upper house election in July are further motivations for a June hike.

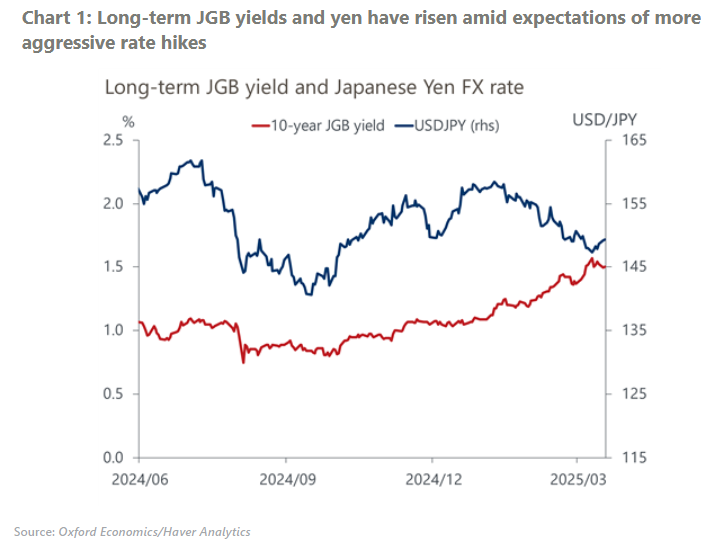

- ”Trump 2.0′ poses various risks to the BoJ policy outlook: high tariffs on autos could have a material effect on growth; higher inflation and interest rates in the US could prompt a sharp fall in the yen and force the BoJ to hike faster; and US pressure on Japan to raise defence spending could increase the neutral rate and destabilise the Japanese government bond (JGB) market.

- We raised our inflation forecast this month to reflect the persistent supply-side inflation pressure on food, especially rice, but didn’t change our policy rate forecast. However, if inflation expectations rise, the BoJ’s terminal rate could turn out to be higher than our projection of 1%.

Tags:

Related Posts

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More