Which regions are most exposed to the 25% automotive tariffs?

The US is set to impose new tariffs beginning April 2, adding an additional 25% on all imports of passenger vehicles, light trucks and certain automotive parts. While there is sufficient spare capacity to accommodate some near-term reshoring to existing US facilities, this would come at the expense of reduced competition, higher prices, and significantly lower production in the US’s main trading partners.

What you will learn:

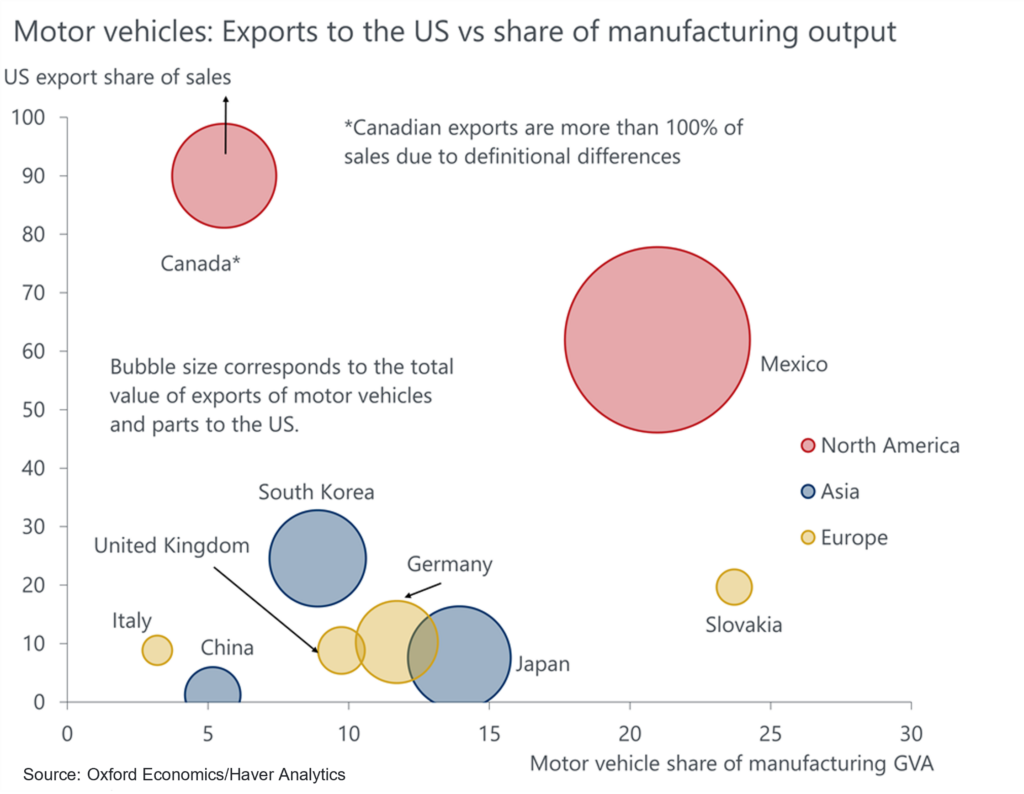

- Tariff disruption will be felt most across the Mexican border states, while Ontario bears the brunt in Canada. Both Canada and Mexico export a large share of total automotive sales to the US, and automotive parts also cross borders several times before final assembly.

- Outside of North America, Japan and South Korea are the largest automotive exporters to the US. Anecdotally, Japanese car companies are preparing to ramp up production at their existing US plants, suggesting that even the threat of tariffs will likely curtail production in Japan.

- While the direct export exposure to the US is smaller in Europe than elsewhere, motor vehicles are an important manufacturing sector in several countries, especially in CEE economies such as Slovakia and the Czech Republic.

- While the tariffs will likely have the effect of reshoring some automotive production to US plants, it will also raise the cost to US manufacturers and households. Our analysis suggests that the tariff applies to nearly one third of the price of the car.

Tags:

Related Reports

Trade tracker – Tariff impacts continue to build

US tariff rates are climbing to levels not seen since the 1930s, with world trade expected to decline and inflation set to rise. What could this mean for global markets and economic growth?

Find Out More

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

US tariffs and the uneven impact across cities in Europe and Asia

The latest US tariffs are reshaping global trade patterns, hitting some cities harder than others. From Germany’s auto hubs to China’s electronics exporters, which regions will weather the storm and which will struggle?

Find Out More

Five lessons for businesses navigating tariffs and trade turmoil

In a rapidly evolving global trade environment, businesses must stay ahead of changing tariffs and regulatory demands. Our latest blog offers practical guidance on navigating tariffs, understanding key trade strategies, and leveraging accurate HS code classifications to optimize your supply chain. Explore essential insights that will help your business manage trade uncertainty, ensure compliance, and unlock new growth opportunities.

Find Out More