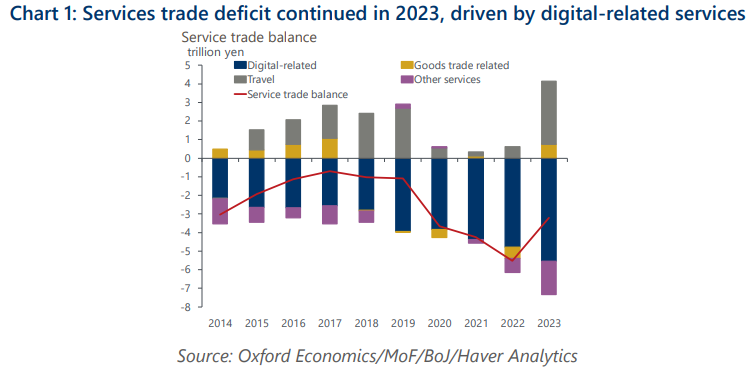

Acceleration in digitalisation will keep a service trade deficit in Japan

Japan’s services trade deficit continued in 2023, despite the sharp recovery to a travel surplus due to a rising number of inbound tourists after the pandemic. We project Japan’s services trade balance will remain in deficit over the coming years as a trend increase in the import of digital-related services will outweigh a rising travel services surplus that has been driven by inbound tourists.

What you will learn:

- In contrast to its success in manufacturing, Japan has been slow in moving up value chain in digital services. An aging population and the pandemic experience will accelerate the belated move toward digitalization, resulting in a demand drain through imports, especially from the US.

- The travel surplus will likely keep rising, driven by inbound tourists. However, it won’t be enough to offset the digital-related services deficit. The increase in the travel surplus will be constrained by a labour shortage in inbound tourism-related businesses and slow progress in raising consumption per head by providing higher value-added tourism services.

- Services trade deserves more attention in terms of its impact on Japan’s external balance and the FX market. Compared to goods trade, services trade has been more dynamic by responding more vividly to FX developments.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More