An inflation resurgence remains low on the worry list

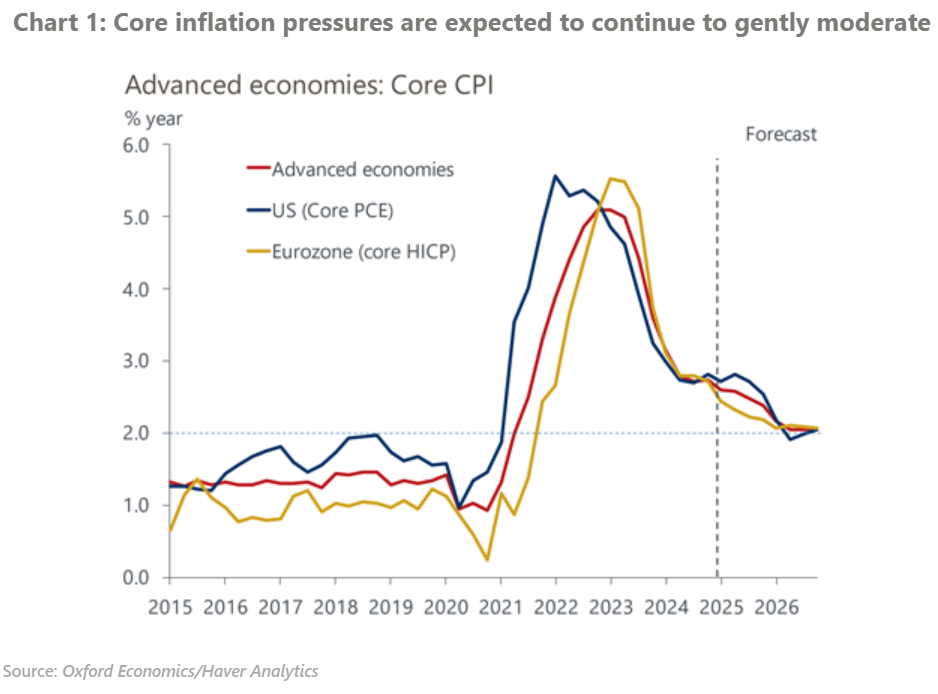

The potential resurgence in inflation has led to sharp moves in market interest rate expectations after the Federal Reserve began to cut policy rates. However, we see little evidence that inflation will take a significant turn for the worse, which suggests that the risks of Trump’s policy agenda unleashing sizeable inflationary pressures in the US, and beyond, have been exaggerated.

What you will learn:

- We’ve long argued that the decline in inflation back to target could prove to be slow and that above-target inflation wouldn’t preclude policy rates from moving into less restrictive territory. Some annual headline inflation measures have recently climbed, but this mainly reflects base effects and shifts in volatile components of the basket, which means there’s no need to panic.

- Future economic policies by the Trump administration could be a catalyst for higher inflation, but our previous work suggests that even a low-probability scenario involving large and broad tariff hikes would have only moderate inflation impacts. Market rate expectations may be placing too much weight on tariffs causing drastic shifts in inflation.

- Although we believe markets overreacted in pricing out future Fed rate cuts beyond this year, we’re even more sceptical that the events of the past month or two warrant an upward readjustment of rate expectations in the Eurozone and the UK. Any evidence of a resurgence in inflationary pressures there is even weaker.

- Aggressive US tariff measures are unlikely to cause highly inflationary retaliatory tariffs. Beyond the shorter term, a significant US tariff shift may likely be more disinflationary than inflationary.

Tags:

Related Services

Post

Trade tracker – Tariff impacts continue to build

US tariff rates are climbing to levels not seen since the 1930s, with world trade expected to decline and inflation set to rise. What could this mean for global markets and economic growth?

Find Out More

Post

Tight BoE vote to cut casts doubt on the path for rates

We still expect the Bank of England to cut Bank Rate by 25bps again in November, despite August's unexpectedly tight vote and the Monetary Policy Committee raising its inflation forecasts. However, our call is made with much less confidence than before.

Find Out More

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More