Future-Proofing the Roads Workforce Across Australia and New Zealand

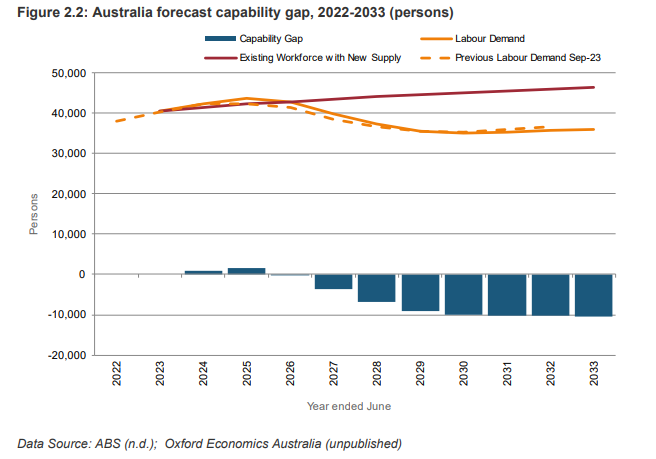

Oxford Economics Australia delivered updated workforce demand forecasts and capability gap modelling using the latest national infrastructure data, equipping Austroads members with interactive dashboards and forward-looking analysis to inform policy and workforce planning.

Background: Rising Road Activity, Shrinking Talent Pool: Are We Ready?

Australia and New Zealand’s road sectors are undergoing a historic boom in construction and maintenance activity, driven by mega-projects and long-term transport policy shifts. However, agencies face mounting pressure to find the skilled workforce needed to meet future road infrastructure demand. Without clear insight into when, where, and how these workforce shortages will emerge, governments risk delays, cost blowouts, or underutilized investment.

The Challenge – Tracking Future Gaps in a Dynamic, State-by-State Landscape

With fluctuating funding, shifting project pipelines, and competing sectors drawing from the same talent pool, road agencies must make regionally tailored decisions in real-time. The challenge lies in forecasting workforce supply and demand across jurisdictions—balancing migration flows, education outcomes, and attrition risks—all while adapting to updated budget announcements and construction delays.

The Solution – Data-Driven Planning Tools to Guide Workforce Resilience

Oxford Economics Australia delivered a future-facing capability analysis across Australia and New Zealand through:

- An extended 10-year forecast (to FY33) of labour demand across 10 regions.

- State-specific capability gap modelling for construction, maintenance, and operations.

- Detailed projections on workforce attrition and new supply (via migration and education).

- Integration of updated economic and infrastructure inputs from national/state budgets.

- An interactive Tableau dashboard for Austroads members to explore scenarios by skill, region, and timeframe.

Impact:

This tailored insight enables Austroads and member agencies to target workforce development policies, adjust education incentives, and engage early with industry partners to close emerging gaps—ensuring projects remain on time, on budget, and adequately staffed.