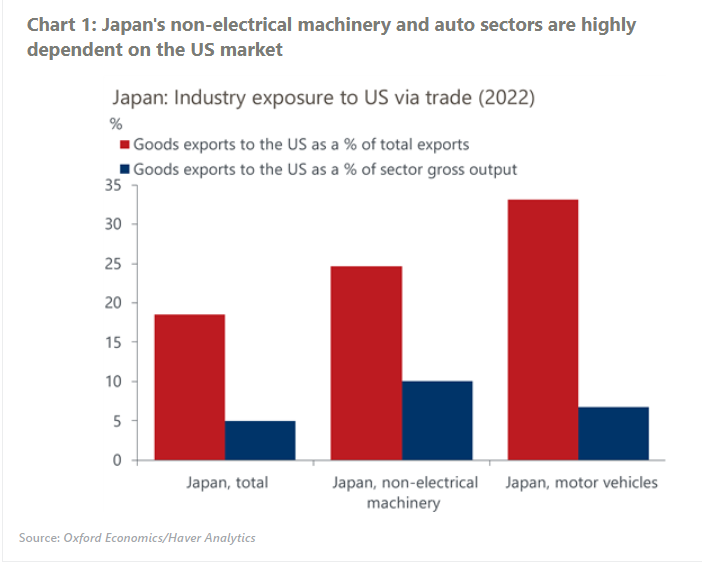

Autos and machineries in Japan are most vulnerable to US tariffs

Our analysis of industry and trade structure between the US and Japan reveals the auto and non-electrical machinery sectors are most vulnerable to tariffs by the US. For both sectors, the US accounts for a sizeable share of total exports as well as gross output, and particularly so for auto.

What you will learn:

- On the other hand, imports from Japan accounts for a relatively small share of the US market, making it easy for the US to impose tariffs. Even for the most exposed sector, 20% tariffs on Japanese goods will translate into less than a 0.5% rise in US output prices. This uneven power balance presents the US with a chance to use tariffs as a means to gain diplomatic leverage.

- However, Japan could resort to retaliatory tariffs, given relatively small reliance on US input for production. For most sectors, the intermediate input from the US accounts for less than 2% of gross output. Items such as agricultural products might be targeted, given Japan holds a relatively sizeable share of total US exports.

- Even in the absence of bilateral tariffs on Japan, globalised supply chains mean Japan could still be hit by tariffs on other economies. Tariffs on Mexico will be detrimental to Japanese automakers who have a production hub in the country, while those on Taiwan semiconductors could dampen demand for Japanese chip equipment.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More