Bank of Japan resumes rate normalisation, cautiously

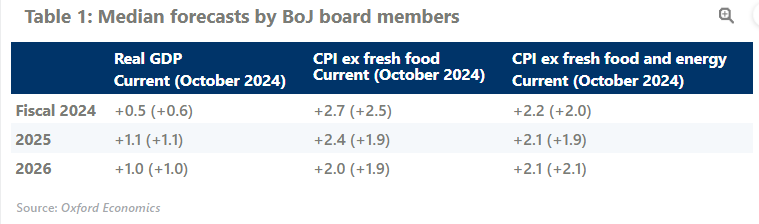

The Bank of Japan raised the policy rate by 0.25ppts to 0.5% at Friday’s meeting, as we expected. We maintain our call that the central bank will hike the rate again to 0.75%, most likely in July after the outcome of the Spring Wage Negotiation is confirmed, especially for small firms.

What you will learn:

- The BoJ expects a strong wage settlement this year comparable to 2024. We project wage growth of around 4.5% (5.1% in 2024), but risks are tilted to upside. We believe that SMEs will generally manage to follow the wage increases set by leading large firms this year, though risks remain.

- Real income and consumption still lack buoyancy as inflation has stuck around 3% due to supply-side factors, including the impact of yen depreciation. The BoJ expects inflation to decline and stabilize at 2% but a weaker yen could hamper the process. Inflation could stabilize at less than 2% if the pass-through of wage rises to prices fails to gain traction.

- Although the next hike will very likely take place this year, the impact of the yen price and domestic politics makes the timing uncertain. Discussions on the neutral and terminal rates will also increasingly gain attention. We still expect the BoJ will end rate hikes after reaching 1% – our estimate of the neutral rate – in the spring or summer of 2026.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More