Research Briefing

| Jul 17, 2024

Better things to come for global developed market REITs

We believe that developed market real estate investment trusts (DM REITs) are poised for a sustained period of positive performance. This is despite interest rates that are set to remain well above pre-pandemic norms.

What you will learn:

- We forecast a 5.9% annual return for DM REITs over 2024-2028 in US dollar terms, on a GDP-weighted basis for the eurozone, UK, and US.

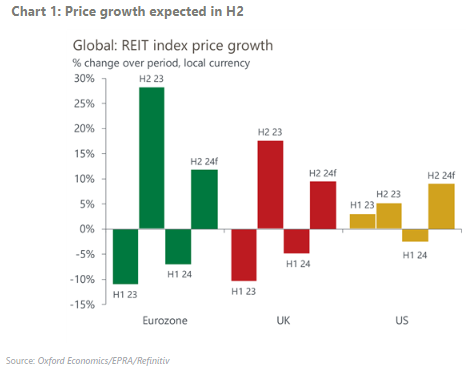

- We stick with our near-term view that a soft economic landing and limited supply will sustain REIT income growth, and that underlying asset values will find a floor as monetary policy gradually eases, which should allow REIT prices to grow over the next six months.

- Although there is uncertainty stemming from the November presidential election, US REITs still look set to outperform over the medium term. The US has a broader and more favourable mix of property sectors in the index and better economic growth prospects.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Office rents entering growth cycle in Australia

CBD office markets in Australia face high vacancy rates, but a supply shortage is expected to drive a strong rent recovery. Effective rents are forecast to rise sharply up to 108% in some cities by FY2035 as vacancy rates fall and incentives normalise.

Read more: Office rents entering growth cycle in Australia

Housing policy outlook clears after Federal Election in Australia

Saturday's Federal Election decisively delivered a second term for the Albanese government, clearing up the policy outlook.

Read more: Housing policy outlook clears after Federal Election in Australia

New indices offer insights into real estate sentiment

Our new suite of sentiment indices show global CRE sentiment has deteriorated significantly this year.

Read more: New indices offer insights into real estate sentiment

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights[autopilot_shortcode]