BoJ on hold ahead of wage negotiation results

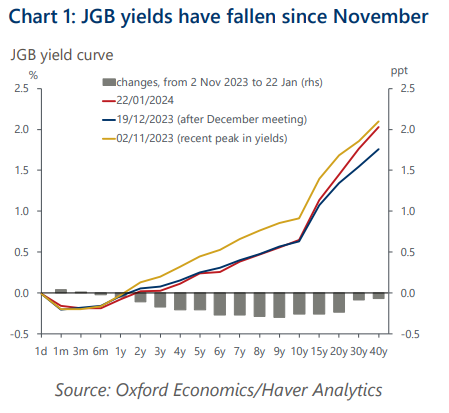

The Bank of Japan left both short-term and long-term policy rates unchanged at Tuesday’s meeting as widely expected. The BoJ was unlikely to change policy this time given the lack of clear evidence on Spring Negotiation pay rises, based on recent comments by the Governor.

What you will learn:

- There were few surprises in the BoJ’s quarterly Outlook Report. Downgrades in the core CPI (excluding fresh foods) for FY2024 mainly reflect changes in crude oil price assumptions, whereas the core-core CPI (excluding fresh foods and energy) forecast was unchanged. However, the BoJ now noted that the likelihood for achieving the inflation target has “continued to gradually rise.”

- Recent CPI data confirm our view that inflation will continue to decline in the next few quarters as pressures from past import inflation abate.

- We maintain our view that the BoJ will abolish its negative interest rate policy (NIRP) at the April meeting, after confirming the wage settlement. After ending the NIRP, we anticipate the BoJ will maintain an effective zero-interest rate policy for a few years, given that achieving the 2% inflation target won’t yet be in sight.

- We believe that the recent earthquake and political turmoil won’t alter the BoJ’s policy path. The macroeconomic impact from the earthquake is not significant on a national level. On the political front, there was little resistance to ditching the NIRP from politicians before, and the public appears to support the direction of monetary policy normalisation after excessive easing.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More