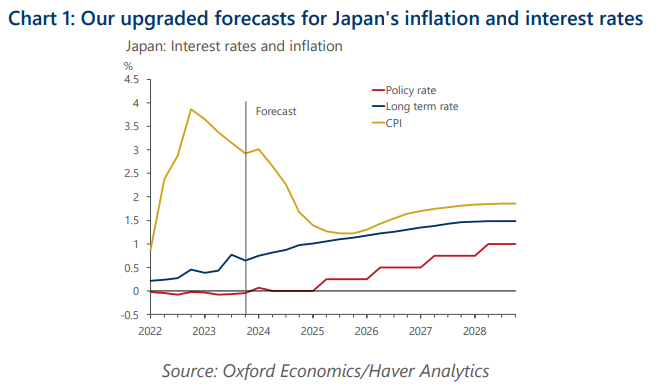

BoJ to raise its policy rate cautiously to 1% by 2028

We now project that the Bank of Japan will start to raise its policy rate next spring assuming another robust wage settlement at the Spring Negotiation. If inflation remains on a path towards 2%, the BoJ will likely raise rates cautiously to a terminal rate of around 1% in 2028.

What you will learn:

- In our view the BoJ’s policy reaction function has changed. If the BoJ continues to give absolute priority to meet the 2% inflation target, it will take a shallower path. However, the bank’s recent moves and messages reveal a strong appetite to return to positive interest rates earlier as long as inflation is broadly heading towards target.

- It’s possible that the next rate hike will happen in H2 2024, depending on the pass-through of wage rises to service prices. Still, the room for the amount of hikes is limited due to the huge downside risks in the price outlook, especially the sustainability of wage rises and pricing power. And even if a labour shortage continues to push up wages and inflation, the BoJ may hesitate to raise the policy rate if household income and consumption remain stagnant.

- Higher short-term policy rates and rising term premium caused by more uncertainty and volatility around inflation and monetary policy means we have raised our estimate for the long-term equilibrium rate for 10-year JGB yields to 1.5% from 0.7%.

- We think the BoJ will devise an exit strategy from QE policy later this year after the policy review that is underway. The BoJ will allow long-term yields to rise gradually driven by fundamentals, but those steps likely will be cautious to avoid a disorderly rise.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More