China’s overcapacity ‘problem’ in five charts

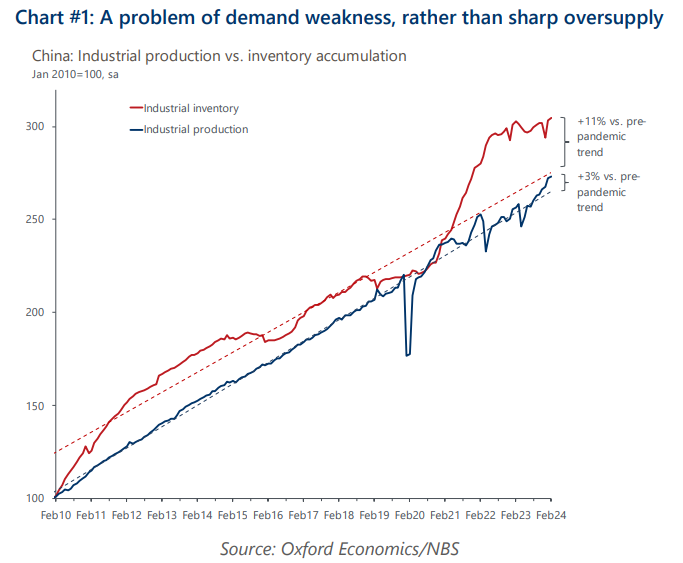

We find emerging, but not overwhelming, macro proof to support the recent geopolitical narrative of excess Chinese goods production that unfairly undercuts global manufacturing competitors on price.

What you will learn:

- Without compelling evidence in the data, there is likely no impetus for authorities to adopt meaningful course-corrective measures to rein in any perceived excess capacity problems zeroed in by Western trading partners anytime soon.

- Obviously, given the soft patch in onshore demand, and a production-driven stimulus approach, China’s industries are likely to exhibit relative cyclical oversupply in the near term.

- Sector-related data suggests that excess capacity risks remain confined within several industries with known idiosyncratic trends at play.

- The contentious ‘new three’ industries underscore China’s export dependency, and global import reliance. Optimists might point to the longer-term global demand fundamentals that support an industrial ramp-up in these areas, although it is unclear if that outweighs the risk of deflation and the associated job losses from persistent unprofitability in pockets of these industries.

Tags:

Related Posts

Post

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

Post

Roadblocks to China’s chip self-sufficiency dream

China is unlikely to achieve full chip self-sufficiency any time soon because of high technological hurdles in producing advanced manufacturing equipment and materials. The self-sufficiency target now stretches well beyond actual fabrication to include the entire chip supply chain as China struggles to acquire necessary input and machinery into the production process.

Find Out More

Post

Five lessons for businesses navigating tariffs and trade turmoil

In a rapidly evolving global trade environment, businesses must stay ahead of changing tariffs and regulatory demands. Our latest blog offers practical guidance on navigating tariffs, understanding key trade strategies, and leveraging accurate HS code classifications to optimize your supply chain. Explore essential insights that will help your business manage trade uncertainty, ensure compliance, and unlock new growth opportunities.

Find Out More